Can medium Earth orbit satellites find their footing amidst fierce competition and market doubts?

- NATO awarded a $200 million contract to SES for medium Earth orbit satellite communications.

- Medium Earth orbit (MEO) offers faster communication than geostationary satellites and is ideal for various applications.

- SES is the only active commercial operator in MEO, but its stock has plummeted over 80% in the last decade.

- The rise of LEO satellites, particularly from Starlink, has disrupted traditional satellite markets.

- SES is exploring hybrid constellations to enhance service and compete with LEO providers.

- Despite having cash reserves and a significant dividend yield, investor confidence in satellite firms remains low.

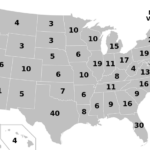

The satellite industry is facing significant challenges, particularly for publicly listed operators. Recently, NATO awarded a $200 million contract to Luxembourg-based SES, the only active commercial operator in medium Earth orbit (MEO), to meet its communication needs. MEO, positioned between low Earth orbit (LEO) and geostationary orbit, offers faster communication speeds, making it suitable for various applications, including navigation and Earth observation. nnDespite its potential, SES has seen its stock value drop over 80% in the past decade, reflecting broader market skepticism towards satellite operators. The rise of Elon Musk’s Starlink, which operates thousands of LEO satellites, has intensified competition, leading traditional firms like Viasat and Eutelsat to explore hybrid satellite constellations that combine LEO and geostationary satellites. nnSES is attempting to leverage its MEO satellites as ‘space relays’ to enhance service delivery, but the company faces hurdles, including power issues with its mPOWER satellites. While SES has cash reserves from selling C-band spectrum for 5G and plans to acquire Intelsat, investor confidence remains shaky. nnThe satellite market is evolving rapidly, with technological advancements allowing for cheaper and more disposable mini-satellites. This shift has led to a decline in traditional satellite TV services, further complicating the landscape for established players. Although SES has a strong operating margin and a dividend yield, it must prove that MEO can deliver on its promise to regain investor trust.·

Factuality Level: 7

Factuality Justification: The article provides a detailed overview of the current state of satellite communications, particularly focusing on medium Earth orbit (MEO) satellites and the challenges faced by companies like SES. While it contains some relevant information and insights, it also includes a few tangential details and opinions that may detract from its overall objectivity. The article does not appear to contain misleading information, but it does present some bias in favor of MEO technology without fully addressing its limitations compared to other orbits.·

Noise Level: 7

Noise Justification: The article provides a detailed analysis of the medium Earth orbit (MEO) satellite market, including the challenges faced by companies like SES and the competitive landscape with Starlink. It discusses the implications of technological advancements and market dynamics, supporting its claims with data and examples. However, while it offers valuable insights, it could benefit from a deeper exploration of the long-term trends and consequences of these developments.·

Public Companies: SES (SES), Viasat (VSAT), Eutelsat (ETL), Intelsat (INTELSAT), Boeing (BA)

Private Companies: SpaceX

Key People: Adel Al-Saleh (Chief Executive at SES), Aleksander Peterc (Analyst at Bernstein)

Financial Relevance: Yes

Financial Markets Impacted: Satellite operators such as SES, Viasat, Eutelsat, Telesat, and SpaceX’s Starlink are impacted by the NATO contract awarded to Luxembourg’s SES for its O3b mPOWER constellation in medium Earth orbit.

Financial Rating Justification: The article discusses financial aspects of satellite operators and their market performance, as well as the impact of a $200 million contract from NATO on these companies.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: The article discusses the launch of satellites and the market dynamics of satellite operators, but does not mention any extreme event that occurred in the last 48 hours.·

Deal Size: 200000000

Move Size: No market move size mentioned.

Sector: Technology

Direction: Down

Magnitude: Large

Affected Instruments: Stocks

www.wsj.com

www.wsj.com