Investors flocked to I-bonds when rates were high, but now is the time for savers to cash in

- New Series I Bond rate is 5.27%

- Combination of 1.3% fixed rate and 3.94% inflation rate

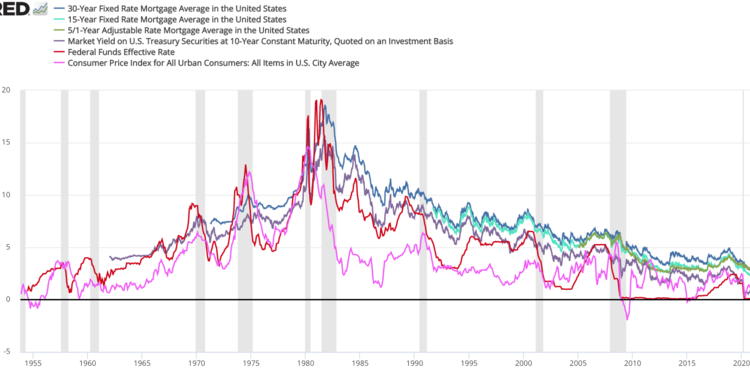

- Highest fixed rate since 2007

- Investors who bought during peak inflation are not getting those rates now

- 0% fixed rate yields 3.94%

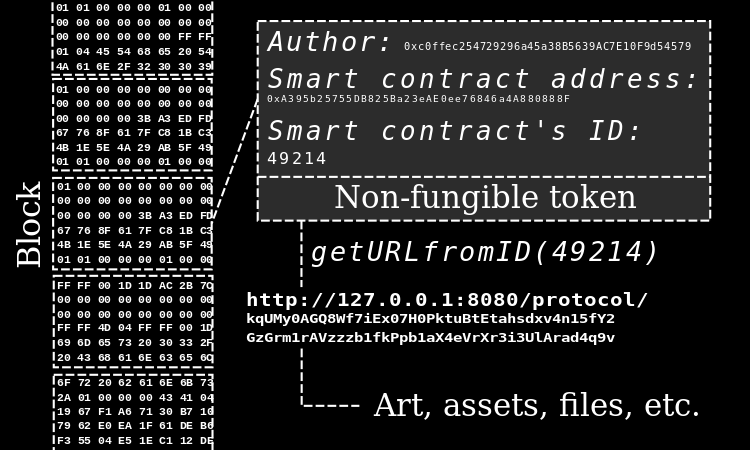

- I-bond rates are a composite of inflation-adjusted rate and fixed rate

- Limited to $10,000 purchase per calendar year

- Cash-out restrictions and tax implications

- Strategy to sell zero percent I-bonds and re-buy at current rates

The new rate for Series I Bonds starting on Nov. 1 will be 5.27%, the highest fixed rate since 2007. Investors who bought during peak inflation are not getting those rates now, with a 0% fixed rate yielding just 3.94%. I-bond rates are a composite of an inflation-adjusted rate and a fixed rate. There are limitations on purchases, cash-out restrictions, and tax implications. A strategy to consider is selling zero percent I-bonds and re-buying at the current rates.

Factuality Level: 7

Factuality Justification: The article provides information about the new rate for Series I Bonds and explains how the rate is determined. It also discusses the advantages and limitations of investing in I-bonds. The information provided is based on statements from experts and official sources. However, the article does not provide any counterarguments or alternative perspectives, which could affect the overall factuality level.

Noise Level: 7

Noise Justification: The article provides information about the new rate for Series I Bonds and explains how it is calculated. It also discusses the historical rates and the advantages and limitations of investing in I-bonds. However, there is some repetitive information and the article could have provided more analysis and insights on the topic.

Financial Relevance: Yes

Financial Markets Impacted: The article provides information about the new rate for Series I Bonds, which may be of interest to investors and individuals considering purchasing these bonds.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the new rate for Series I Bonds, which is relevant to financial topics. However, there is no mention of any extreme event or its impact.

Key People: Ken Tumin (Editor of DepositAccounts.com), David Enna (Editor of Tipwatch.com)

www.marketwatch.com

www.marketwatch.com