Railroad company and activist investor clash ahead of annual meeting

- Norfolk Southern touts progress and criticizes activist investor Ancora Holdings Group

- Board battle intensifies ahead of annual meeting

- Ancora pushing for board overhaul and appointment of new CEO

- Norfolk Southern urges shareholders to vote for its 13 board nominees

- Company highlights improvements in network performance, safety, and service

- Describes Ancora’s strategy as ‘reckless’ and potentially harmful

- Ancora denies plan involves job cuts or furloughing employees

- Shares of Norfolk Southern up 0.5% on Wednesday

- Ancora calls for implementation of precision scheduled railroading at Norfolk Southern

- Proxy-advisory firm ISS recommends voting for most of Norfolk Southern’s board nominees

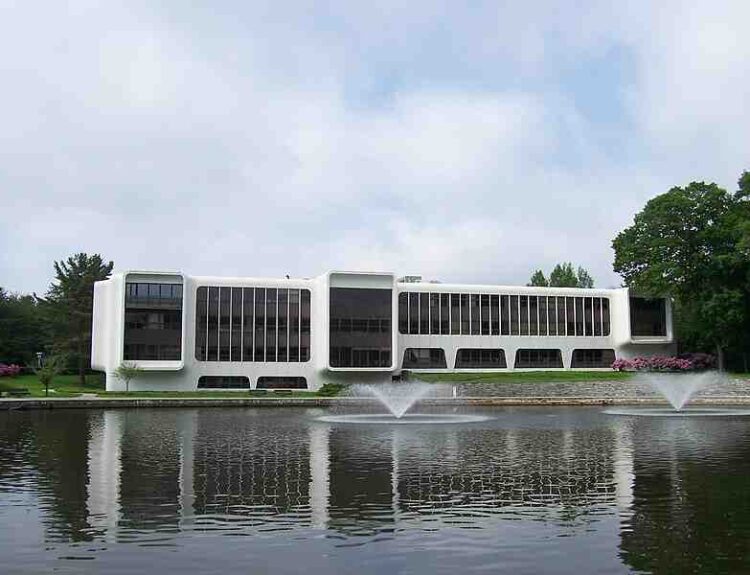

Norfolk Southern Corp. has sent a letter to shareholders touting its progress and criticizing activist investor Ancora Holdings Group. Ancora is pushing for a board overhaul and the appointment of a new CEO. Norfolk Southern is urging shareholders to vote for its 13 board nominees, highlighting improvements in network performance, safety, and service. The company describes Ancora’s strategy as ‘reckless’ and potentially harmful. Ancora denies that its plan involves job cuts or furloughing employees. Shares of Norfolk Southern are up 0.5% on Wednesday. Ancora is calling for the implementation of precision scheduled railroading at Norfolk Southern. Proxy-advisory firm ISS has recommended voting for most of Norfolk Southern’s board nominees.

Factuality Level: 3

Factuality Justification: The article provides information about a corporate battle between Norfolk Southern Corp. and activist investor Ancora Holdings Group. It includes statements from both parties and details their positions on the board nominees and company strategy. However, the article lacks depth and context, and it does not provide a comprehensive analysis of the situation. The article also contains some biased language, especially in the quotes from the involved parties.

Noise Level: 3

Noise Justification: The article provides a detailed overview of the ongoing board battle between Norfolk Southern Corp. and activist investor Ancora Holdings Group. It includes relevant information such as the positions of both parties, their strategies, and the recommendations from proxy-advisory firm ISS. The article stays on topic and supports its claims with quotes and examples. However, there is some repetitive information and the article could benefit from more in-depth analysis of the potential consequences of the board battle on the company and its shareholders.

Financial Relevance: Yes

Financial Markets Impacted: The article pertains to the ongoing board battle between Norfolk Southern Corp. and activist investor Ancora Holdings Group. The outcome of this battle could potentially impact the company’s corporate governance and strategic direction, which may have implications for the company’s financial performance and shareholder value.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article focuses on a corporate governance issue and does not mention any extreme events.

Public Companies: Norfolk Southern Corp. (NSC), United Parcel Service Inc. (UPS)

Private Companies: Ancora Holdings Group

Key People: Jim Barber (Former Chief Operating Officer at United Parcel Service Inc.), Alan Shaw (President and CEO of Norfolk Southern Corp.), Jim Chadwick (President of Ancora Alternatives), Jamie Boychuk (Candidate for Norfolk Southern Chief Operating Officer from Ancora)

Reported publicly:

www.marketwatch.com

www.marketwatch.com