Nvidia’s valuation nears $2 trillion as it focuses on AI in telecommunications

- Nvidia stock has more than tripled in value over the last 12 months

- Nvidia is targeting the telecommunications industry to expand its AI technology

- Nvidia shares were up 1.2% in premarket trading

- The company is valued at around $1.97 trillion overall

- Nvidia is partnering with ServiceNow to build generative AI offerings for telecoms companies

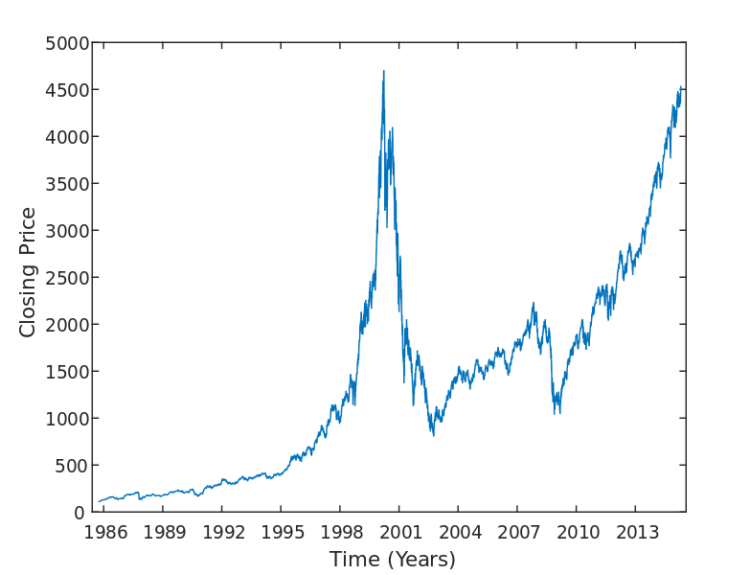

Nvidia shares have experienced a significant surge in value, more than tripling over the past year. The chip maker is now setting its sights on the telecommunications industry, aiming to expand its artificial intelligence technology. In premarket trading, Nvidia shares were up 1.2%, reaching a valuation of around $1.97 trillion. Wall Street analysts remain optimistic about the stock’s future, driven by the high demand for Nvidia’s graphics-processing units for AI systems. To further solidify its position, Nvidia has partnered with workflow-management software company ServiceNow to develop generative AI solutions tailored for telecoms companies. The first product to be released will be a customer-service platform. Other chip stocks, such as Advanced Micro Devices and Intel, also experienced gains in early trading. So far this year, Nvidia stock has risen by 59%, outperforming the S&P 500 and Nasdaq Composite Index.

Factuality Level: 3

Factuality Justification: The article provides factual information about Nvidia’s stock performance and partnerships, but it lacks depth and context. It does not address potential risks or challenges facing the company, and it focuses heavily on positive aspects without presenting a balanced view. The article also contains some unnecessary details and repetitions, such as repeatedly mentioning stock prices and percentage changes.

Noise Level: 3

Noise Justification: The article provides relevant information about Nvidia’s stock performance, its expansion into artificial intelligence technology, and partnerships in the telecommunications industry. It includes data on stock prices, analyst recommendations, and industry trends. However, the article lacks in-depth analysis, accountability of powerful people, and actionable insights.

Financial Relevance: Yes

Financial Markets Impacted: The article provides information about Nvidia, a chip maker, and its rising valuation. It also mentions other chip stocks like Advanced Micro Devices and Intel.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the financial performance and market trends of Nvidia and other chip stocks. There is no mention of any extreme events or significant impacts.

Public Companies: Nvidia (NVDA), ServiceNow (N/A), Advanced Micro Devices (AMD), Intel (INTC)

Key People:

Reported publicly:

www.marketwatch.com

www.marketwatch.com