Bank’s net profit increases and announces offer for insurance arm

- OCBC reports rise in first-quarter net profit

- Makes S$1.4 billion offer for insurance arm

- Net profit rose 5.0% on year to S$1.98 billion

- Total income gained 8.0% on year to S$3.63 billion

- Non-interest income was up 17% to S$1.19 billion

- Bank’s total allowances were S$169 million

- CEO expects key markets in Asia to be resilient

- Warns of near-term risks due to geopolitical tensions

- OCBC making cash offer of S$25.60 a share to buy shares of Great Eastern Holdings

- Offer is a 36.9% premium to Great Eastern’s last traded price

Oversea-Chinese Banking Corp. (OCBC) reported a 5.0% rise in first-quarter net profit to S$1.98 billion. The bank’s total income also increased by 8.0% to S$3.63 billion, with non-interest income up by 17% to S$1.19 billion. However, the bank’s total allowances rose to S$169 million, mainly due to impairment charges. OCBC’s CEO, Helen Wong, expects the bank’s key markets in Asia to remain resilient, but warns of near-term risks due to geopolitical tensions. In addition, OCBC announced a cash offer of S$25.60 a share to buy the remaining shares of Great Eastern Holdings, in which it already owns a majority stake. The offer represents a 36.9% premium to Great Eastern’s last traded price.

Factuality Level: 8

Factuality Justification: The article provides factual information about Oversea-Chinese Banking Corp.’s first-quarter financial results, including net profit, total income, net interest income, non-interest income, and allowances. It also includes a statement from the bank’s CEO and details about a privatization offer for its insurance arm. The article does not contain irrelevant information, misleading details, sensationalism, redundancy, or opinion masquerading as fact. Overall, the article presents objective and accurate information about the financial performance and strategic moves of the bank.

Noise Level: 3

Noise Justification: The article provides a clear and concise overview of Oversea-Chinese Banking Corp.’s first-quarter performance, including key financial figures and strategic moves such as the privatization offer for its insurance arm. It stays on topic and does not contain irrelevant or misleading information. The article supports its claims with specific data and examples, making it informative and relevant for readers interested in the banking sector.

Financial Relevance: Yes

Financial Markets Impacted: Oversea-Chinese Banking Corp. (OCBC)

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article pertains to financial topics as it discusses the first-quarter net profit of OCBC and its privatization offer for its insurance arm. There is no mention of an extreme event.

Public Companies: Oversea-Chinese Banking Corp (OCBC), Great Eastern Holdings (N/A)

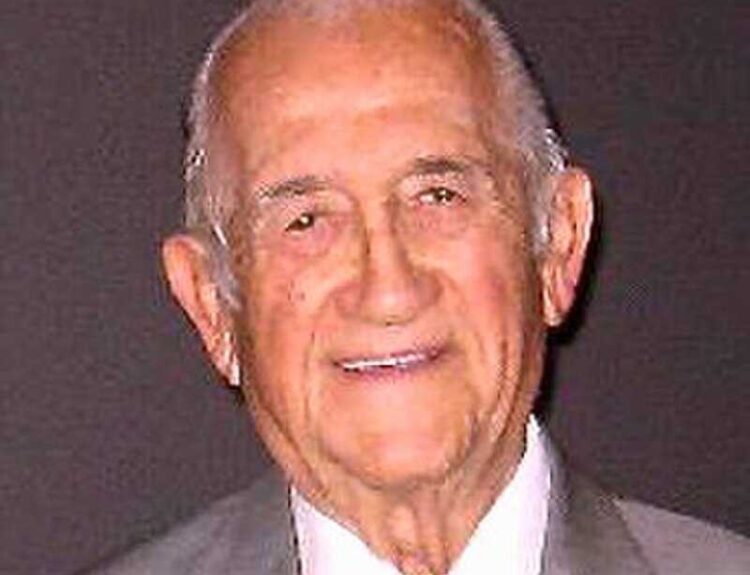

Key People: Helen Wong (Chief Executive Officer)

Reported publicly:

www.marketwatch.com

www.marketwatch.com