Contango indicates a bearish outlook for crude prices

- Oil market slipping into contango

- Contango indicates a bearish outlook for crude prices

- Backwardation is seen as bullish, indicating a tight physical market

- WTI price curve briefly traded in contango earlier this month

- Weak physical market and potential crude surpluses contributing to contango

- Investors pay attention to the shape of the futures curve

- Rising production and noncompliance with OPEC+ cuts causing contango

- Deeper move into contango can become self-reinforcing

- Deep contango is a tough place for speculators to make money

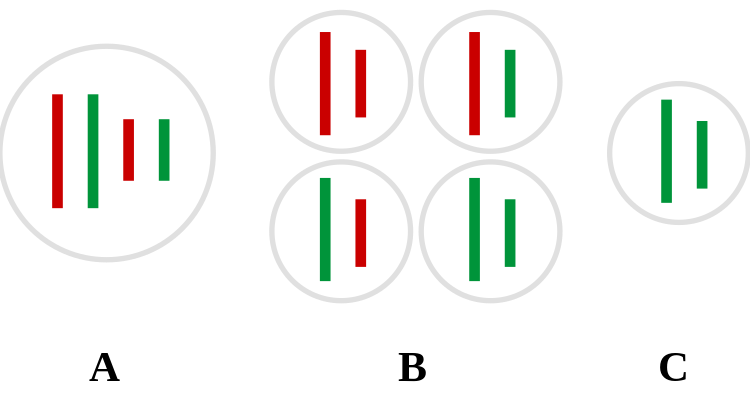

The oil market is slipping into a state known as contango, which is a bearish sign for crude prices. Contango occurs when nearby futures contracts trade at a discount to deferred contracts. This shift is often seen as a negative indicator, reflecting a weak physical market and the potential for crude surpluses. In contrast, a move into backwardation, where nearby contracts trade at a premium, is considered bullish and indicates a tight physical market. The WTI price curve briefly traded in contango earlier this month, signaling a shift in market sentiment. Rising production and noncompliance with OPEC+ production cuts are contributing to the contango. Investors pay attention to the shape of the futures curve, as it has historically been a predictor of future returns. A deeper move into contango can become self-reinforcing, putting pressure on spot prices and making it difficult for speculators to make money.

Factuality Level: 7

Factuality Justification: The article provides an explanation of the terms ‘contango’ and ‘backwardation’ in the oil market and discusses the current state of the oil market. It includes quotes from experts and references historical data. However, it does not provide a comprehensive analysis of all factors affecting crude prices and does not present opposing viewpoints.

Noise Level: 6

Noise Justification: The article provides some useful information about the concept of contango in the oil market and its implications for crude prices. However, it lacks depth and analysis, and there is a lot of repetition of information. The article also does not provide any evidence or data to support its claims. Overall, it is a decent introduction to the topic but lacks substance.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the oil market and its impact on crude prices.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article does not mention any extreme events or their impacts.

Public Companies: Mizuho Securities (N/A)

Private Companies: Macquarie

Key People: Robert Yawger (Executive Director for Energy Futures at Mizuho Securities), Vikas Dwivedi (Global Energy Strategist at Macquarie)

www.marketwatch.com

www.marketwatch.com