Candidates prioritize political gain over sound economic policies, risking future consequences.

- Economists warn against price controls, tariffs, and budget deficits, yet candidates are embracing these policies.

- Trump and Harris propose tax changes that could create inequities and inefficiencies in the labor market.

- Price controls and rent regulations may hinder supply and lead to unintended consequences.

- Tariffs are seen as a tax on imports, potentially harming consumers and the economy.

- Candidates are engaging in a fiscal arms race with expensive tax credits that could worsen the budget deficit.

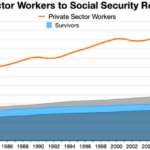

As the November presidential election approaches, one clear loser is emerging: economics. Despite the advice of economists against price controls, tariffs, and budget deficits, candidates like Donald Trump, Joe Biden, and Kamala Harris are embracing these controversial policies. While some may argue that these measures can be justified in certain situations, the current political climate suggests a complete disregard for established economic principles. Columbia University economist Glenn Hubbard expressed concern over the lack of economic expertise in campaign strategies, questioning whether anyone is listening to economists anymore. nnOne notable proposal is Trump’s plan to eliminate taxes on tips, which has been quickly adopted by Harris. This policy is both inequitable and inefficient, as it disproportionately affects workers who earn wages over those who rely on tips. Additionally, it could lead to more compensation being structured as tips, ultimately burdening consumers with higher prices. nnHarris and Biden are also advocating for measures to control rent increases, suggesting that corporate landlords who raise rents by more than 5% should lose federal tax benefits. While this may seem like a solution to rising rents, it could stifle supply and lead to unintended consequences, such as developers raising rents preemptively or reducing new construction. nnTariffs, which economists generally oppose, are another area of concern. Trump’s proposed tariffs on imports aim to encourage consumers to buy domestic products, but this could lead to higher costs for consumers without addressing the underlying issues of trade deficits. nnFinally, the candidates are engaging in a fiscal arms race, proposing expensive tax credits that could exacerbate the already high budget deficit. Harris’s $6,000 tax credit for newborns and Trump’s proposal to eliminate income taxes on Social Security benefits could cost trillions over the next decade, raising concerns about the sustainability of such policies. nnIn summary, while these proposals may be politically appealing, they risk undermining sound economic principles and could have lasting negative effects on the economy.·

Factuality Level: 6

Factuality Justification: The article presents a mix of factual information and opinion, particularly regarding economic policies proposed by political candidates. While it discusses economic principles and critiques specific proposals, it also includes subjective interpretations and predictions that may not be universally accepted. The article lacks some clarity in distinguishing between opinion and fact, which affects its overall factuality.·

Noise Level: 7

Noise Justification: The article provides a critical analysis of economic policies proposed by political candidates, highlighting potential consequences and inconsistencies. It references expert opinions and data to support its claims, maintaining a focus on the topic of economic implications in politics. However, it could benefit from a more in-depth exploration of alternative solutions or insights.·

Key People: Donald Trump (Former President), Joe Biden (President), Kamala Harris (Presidential Candidate), Glenn Hubbard (Economist, former chair of President George W. Bush’s Council of Economic Advisers), Alexei Alexandrov (Former Chief Economist of the Federal Housing Finance Agency), Elizabeth Warren (Senator (D., Mass.)), JD Vance (Trump’s Running Mate)

Financial Relevance: Yes

Financial Markets Impacted: The article discusses economic policies proposed by presidential candidates that could significantly impact taxation, tariffs, and price controls, affecting financial markets and corporate profitability.

Financial Rating Justification: The article analyzes the economic implications of various political proposals, highlighting how these policies could influence market dynamics, consumer behavior, and overall economic health, making it highly relevant to financial topics.·

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: The article discusses economic policies and proposals from political candidates but does not report on any extreme event that occurred in the last 48 hours.·

Move Size: No market move size mentioned.

Sector: All

Direction: Down

Magnitude: Large

Affected Instruments: Stocks

www.wsj.com

www.wsj.com