Citigroup’s Potential Shift in Focus Under CEO Jane Fraser

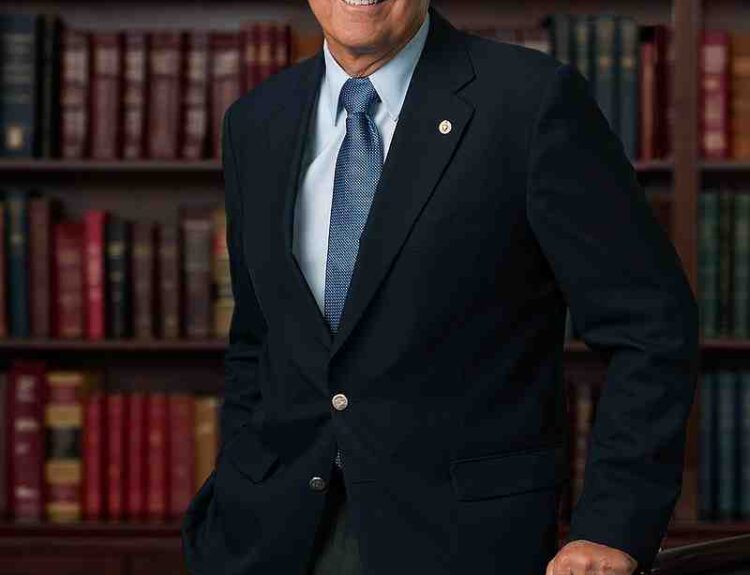

- Citigroup’s CEO Jane Fraser overseeing bank’s overhaul

- Bank of America analysts suggest selling wealth management business

- Wealth segment has inefficiency and uncertain competitive positioning

- Citi shares up 30% in past year, down from record high in 2006

- Citi hired Andy Sieg as head of wealth management last year

- Investors to watch for updates on wealth management performance

Citigroup CEO Jane Fraser is overseeing the bank’s transformation, which includes shedding businesses and cutting jobs. Bank of America analysts suggest that Citigroup could consider selling its wealth management business due to its inefficiency and uncertain competitive positioning. The bank has exited various markets and hired new leadership to boost performance. Shares have risen 30% in the past year, but are still down from a 2006 record high. Investors will be watching for updates on wealth management progress.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about Citigroup’s potential sale of its wealth management business, citing Bank of America equity analysts’ suggestions and discussing the bank’s recent actions in other markets. It also includes relevant background information on Jane Fraser’s vision for Citi and the performance of the wealth segment. The article does not include any bias or personal perspective presented as a universally accepted truth.

Noise Level: 6

Noise Justification: The article provides some relevant information about Citigroup’s potential sale of its wealth management business and the bank’s recent changes in leadership, but it also includes unnecessary details such as the mention of a text-to-speech technology feature and unrelated historical stock performance. The article could benefit from more focus on the main topic and less speculation about possible outcomes.

Public Companies: Citigroup (C), Bank of America (BAC), HSBC (HSBC), Morgan Stanley (MS), JPMorgan Chase (JPM), General Electric (GE)

Key People: Jane Fraser (Chief Executive of Citigroup), Ebrahim Poonawala (BofA Securities Analyst), Andy Sieg (Head of Wealth at Citigroup), Vis Raghavan (Head of Banking at Citigroup), Larry Culp (CEO of GE Aerospace)

Financial Relevance: Yes

Financial Markets Impacted: Citigroup, Bank of America, HSBC

Financial Rating Justification: The article discusses Citigroup’s potential sale of its wealth management business and the impact on financial markets and companies such as Bank of America and HSBC. It also mentions Citigroup’s performance in the past year and its exit from businesses outside the U.S., which could affect the bank’s future strategy.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article.

www.marketwatch.com

www.marketwatch.com