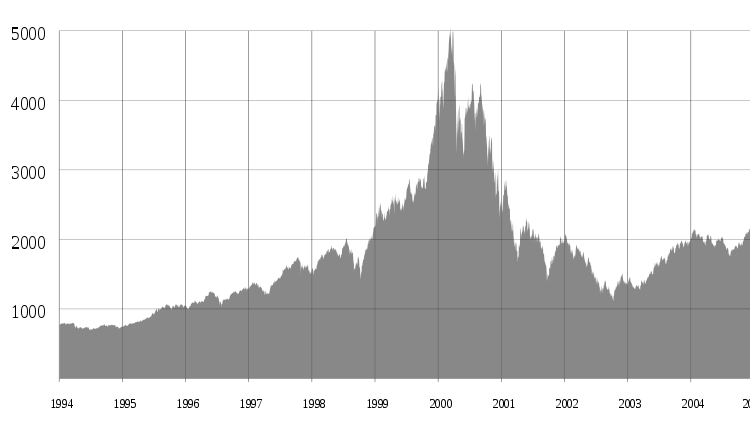

Cocoa futures surge 110% over past year in weather-driven rally

- Cocoa prices have reached their highest levels on record

- Cocoa futures surged 110% over the past year

- Consumers will face higher prices for Valentine’s Day chocolates

- Hot and dry weather in West Africa is affecting crop estimates

- Limited supplies and Harmattan winds are also contributing to the rise in prices

- Valentine’s Day is one of the biggest chocolate-buying seasons in the US

- Chocolate makers buy cocoa months in advance

- There is a limit to what consumers will pay for chocolates

- Recent earnings reports indicate stress on the demand side of the trade

- Cocoa prices are expected to top out soon

Cocoa prices have reached their highest levels on record, with cocoa futures surging 110% over the past year. This surge is impacting the prices of chocolates for Valentine’s Day, one of the biggest chocolate-buying seasons in the US. The rise in prices can be attributed to various factors, including hot and dry weather in West Africa, limited supplies, and Harmattan winds. Chocolate makers typically buy cocoa months in advance, but the current record price levels have not been fully factored into production costs yet. However, there is a limit to what consumers are willing to pay for chocolates, and recent earnings reports indicate stress on the demand side of the trade. Analysts believe that cocoa prices are expected to top out soon, although the exact timing is uncertain. Despite the challenges to production, cocoa demand seems to have held up better than expected. While the topping process may occur soon, it won’t have much impact on Valentine’s Day chocolates, as they have already been purchased and paid for.

Public Companies: RJO Futures (N/A), ICE Futures U.S. (N/A), Dow Jones Market Data (N/A), ChAI (N/A), WeatherWealth (N/A), International Cocoa Organization (N/A), National Confectioners Association (N/A), Hershey Co. (HSY), Modelez International Inc. (MDLZ)

Private Companies: Cadbury

Key People: John Caruso (Senior Market Strategist at RJO Futures), Tristan Fletcher (Chief Executive Officer at ChAI), James Roemer (Publisher of WeatherWealth newsletter), Michele Buck (CEO of Hershey Co.)

Factuality Level: 7

Justification: The article provides information about the rise in cocoa prices and the factors contributing to it, such as supply constraints and weather conditions. It includes quotes from market experts and data on cocoa futures. However, there is some speculation about future price movements and the impact on Valentine’s Day chocolate sales.

Noise Level: 3

Justification: The article provides relevant information about the rise in cocoa prices and its impact on Valentine’s Day chocolate sales. It includes quotes from market experts and data on cocoa futures. However, there is some repetitive information and the article does not provide a deep analysis of long-term trends or antifragility.

Financial Relevance: Yes

Financial Markets Impacted: Cocoa prices reaching record levels may impact companies in the chocolate industry, particularly those that rely heavily on cocoa as a key ingredient.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the record-high cocoa prices, which can have financial implications for companies in the chocolate industry. However, there is no mention of any extreme events.

www.marketwatch.com

www.marketwatch.com