Goldman Sachs prioritizes sophisticated platform for advisors

- Richard Lofgren leads Goldman Sachs’ RIA Custody Business

- Goldman Sachs sees the custody business as a high priority

- Significant investments planned for the coming year

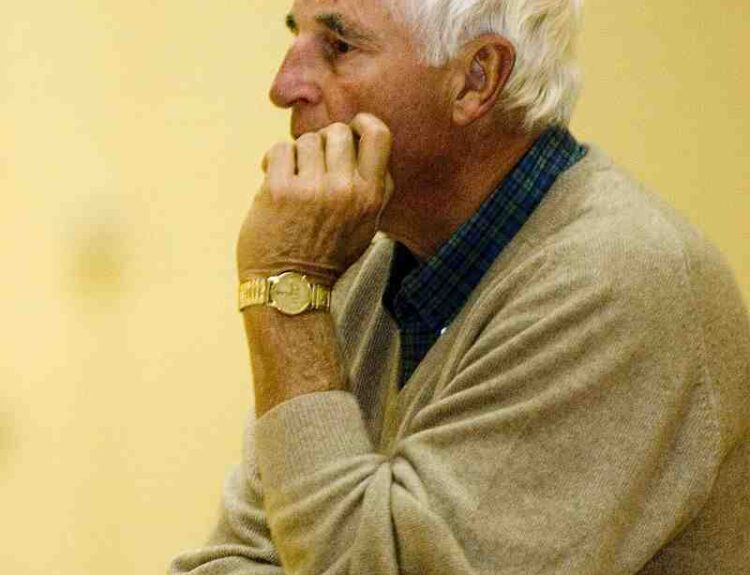

Richard Lofgren, head of advisor engagement for Goldman Sachs Advisor Solutions, leads the Wall Street giant’s RIA Custody Business. The business is considered a high priority for Goldman Sachs, with significant investments planned for the coming year. Lofgren notes that the pipeline for registered investment advisors seeking a sophisticated platform to serve wealthy clients with complex financial needs is looking bright.

Public Companies: Goldman Sachs (GS)

Private Companies:

Key People: Richard Lofgren (Head of Advisor Engagement for Goldman Sachs Advisor Solutions)

Factuality Level: 3

Justification: The article provides some information about Richard Lofgren and Goldman Sachs’ plans for their custody business, but it lacks specific details and relevant context. It also includes unnecessary information about the author being a subscriber to Barron’s Advisor.

Noise Level: 2

Justification: The article is very short and lacks substantial information. It mainly consists of a brief mention of Richard Lofgren and Goldman Sachs’ plans for their custody business. There is no analysis, evidence, or actionable insights provided. The article also diverts into unrelated territory by mentioning the subscriber login process.

Financial Relevance: Yes

Financial Markets Impacted: Goldman Sachs

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article pertains to financial topics as it discusses Goldman Sachs’ custody business and their plans for significant investments in the coming year.

www.barrons.com

www.barrons.com