Don’t let the rising cost of living derail your retirement plans

- Four in 10 Americans are more stressed about rising cost of living

- 69% of Americans are afraid rising cost of living will impact retirement savings

- Student debt repayment is a roadblock to retirement savings

- Workers should balance long-term savings goals with repayment plans

- Even minimal contributions to retirement accounts are better than none

- Retirement-related resolutions include downsizing spending and targeting rising costs

- Prioritize savings and future financial security over present day luxuries

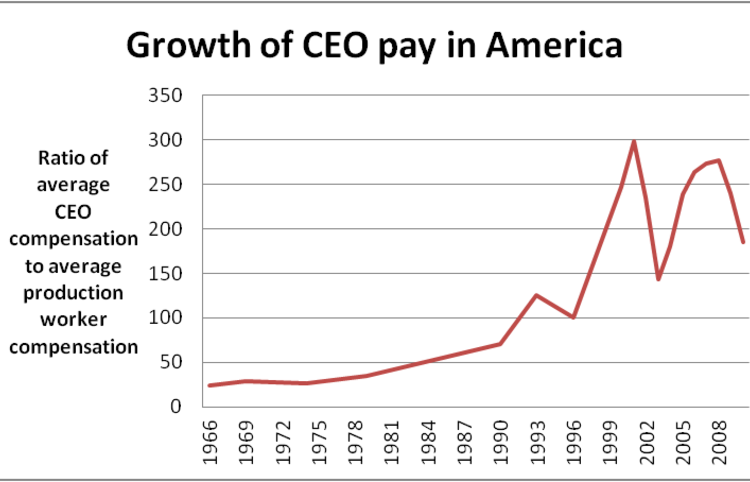

The rising cost of living is causing stress for many Americans who are trying to save for retirement. According to a study by Allianz Life Insurance Company of North America, four in 10 Americans reported feeling more stressed at the end of 2023 compared to the previous year. Day-to-day expenses, low income, and debt were identified as the main sources of stress. Inflation is also a concern, with 69% of Americans worried about its impact on retirement savings. Student debt repayment is a major roadblock for many, leading them to cut their retirement contributions. However, it is important to balance long-term savings goals with repayment plans. Even minimal contributions to retirement accounts can make a difference. It is recommended to prioritize savings and future financial security over present day luxuries. Downsizing spending and creating a plan to address rising costs of living are common resolutions among those planning for retirement. By setting up automatic transfers into savings accounts and being mindful of expenses, individuals can combat inflation and work towards their retirement goals.

Public Companies: Allianz Life Insurance Company of North America (null)

Private Companies:

Key People: Andrew Herzog (Certified Financial Planner and Associate Wealth Manager at The Watchman Group)

Factuality Level: 7

Justification: The article provides information from a study conducted by Allianz Life Insurance Company of North America, which indicates that four in 10 Americans were more stressed at the end of 2023 compared to the previous year. It also mentions that day-to-day expenses, low income, overbearing debt, and inflation were factors contributing to this stress. The article includes statistics from the survey and quotes from a certified financial planner. However, it does not provide any counterarguments or alternative perspectives, and it does not cite any other sources to support the claims made in the article. Therefore, while the information presented may be accurate, the lack of additional sources and perspectives lowers the factuality level of the article.

Noise Level: 3

Justification: The article provides relevant information about the rising cost of living and its impact on retirement savings. It includes statistics from a study conducted by Allianz Life Insurance Company and offers advice from financial experts. However, there are some filler sentences and repetitive information that could be condensed.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the rising cost of living and its impact on Americans’ ability to save for retirement. This could have implications for financial markets as individuals may have less disposable income to invest or contribute to retirement accounts.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article primarily focuses on the financial stress caused by the rising cost of living and its impact on retirement savings. While it does not mention any extreme events or specific financial companies, the topic of financial stress and retirement savings is relevant to financial markets and individuals’ financial well-being.

www.marketwatch.com

www.marketwatch.com