Investing in unstable countries, political impacts, and market strategies

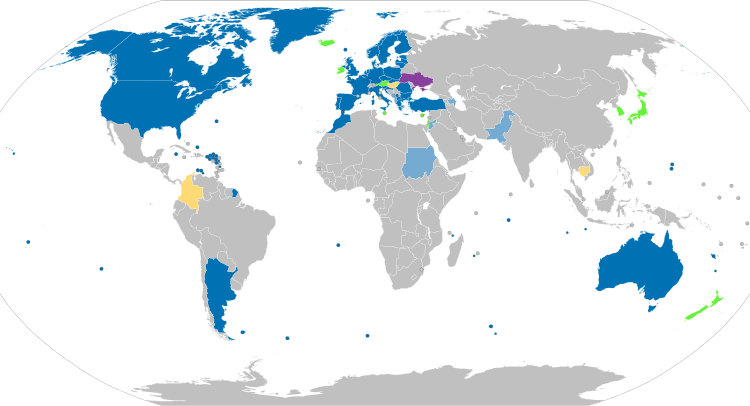

- Investing in unstable African countries with Chinese financial backing is risky

- TotalEnergies’ $10 billion bet on the world’s longest heated oil pipeline

- Concerns about the risk of investing in Total as the largest holding in an international exchange-traded fund

- The potential impact of a second Trump term on the markets and economy

- The importance of democratic norms for sustainable and inclusive growth

- The need for tighter due diligence in the face of potential changes under a Trump 2.0

- The relationship between liquidity, monetary policy, and financial conditions

- The benefits of a strategy involving call option selling in the stock market

Investing in unstable African countries with historically sketchy politics is already tough and risky. TotalEnergies’ $10 billion bet on the world’s longest heated oil pipeline adds to the risk with a dependence on Chinese financial backing. This raises concerns about the risk of investing in Total as the largest holding in an international exchange-traded fund. The potential impact of a second Trump term on the markets and economy is also a topic of discussion. While some believe it could bode well for investors and consumers, others argue that destabilizing democratic norms undercuts the operating environments that companies need for sustainable and inclusive growth. The importance of democratic norms for business success cannot be underestimated. Under a potential Trump 2.0, business as usual will look very different, requiring greater due diligence. Additionally, the relationship between liquidity, monetary policy, and financial conditions is a complex one. Tighter monetary policy may not always align with tighter junk spreads and a softening national Financial Conditions Index. Finally, a strategy involving call option selling in the stock market is highlighted as a way to navigate the market’s hazards and generate returns, especially in individual retirement accounts.

Factuality Level: 1

Factuality Justification: The article contains multiple letters to the editor that are filled with personal opinions, biases, and tangential information. There is no objective reporting or factual information presented in the article.

Noise Level: 2

Noise Justification: The article contains multiple letters to the editor that provide thoughtful analysis and insights on various topics such as investments, political implications, and economic policies. The content is relevant, well-structured, and provides valuable perspectives, making it a low noise level article.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the potential risks of investing in unstable African countries with Chinese financial backing, as well as the impact of former President Donald Trump’s policies on the markets and economy.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article primarily focuses on the financial implications of investing in certain countries and the potential impact of political events on the markets, but does not describe any extreme events.

Public Companies: TotalEnergies (not available)

Key People: Stephen Jewell (not available), Sandra S. Martin (Managing Director of Martin Investment Management), Dave Johnson (not available), Steven M. Sears (not available), Anthony Bavedas (not available)

Reported publicly:

www.marketwatch.com

www.marketwatch.com