Online brokerage firm reports improved financials but faces user decline

- Robinhood Markets narrowed its loss in the third quarter

- Revenue grew 29% to $467 million

- Monthly active users declined 16% to 10.3 million

- Net interest revenue increased 96% to $251 million

- Transaction-based revenue decreased 11% to $185 million

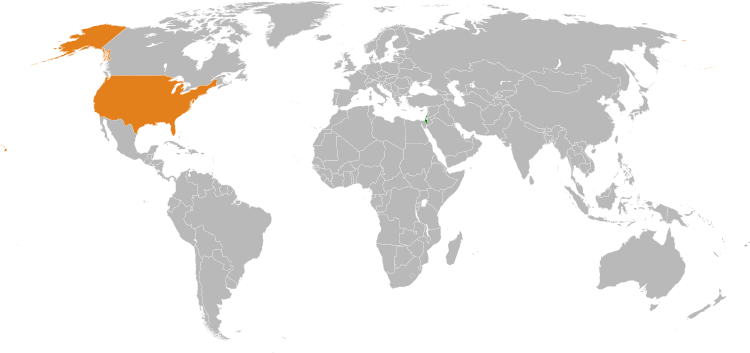

- Robinhood plans to launch cryptocurrency trading in the European Union

Robinhood Markets, the online brokerage firm, reported a narrower loss in the third quarter as revenue grew by 29% to $467 million. However, the company also experienced a decline in monthly active users, which dropped by 16% to 10.3 million. The growth in revenue was primarily driven by higher net interest and other revenue, while transaction-based revenue decreased by 11%. Net interest revenue saw a significant increase of 96% to $251 million, attributed to growth in interest earning assets and higher short-term interest rates. In addition, Robinhood announced plans to launch cryptocurrency trading in the European Union, following its successful launch in the U.K.

Public Companies: Robinhood Markets (N/A)

Private Companies:

Key People:

Factuality Level: 8

Justification: The article provides specific financial figures and metrics, such as the company’s quarterly loss, revenue growth, and decline in monthly active users. It also mentions analysts’ expectations and provides information about the reasons behind the revenue growth and decline in transaction-based revenue. However, the article lacks additional context or analysis, and it does not provide any opposing viewpoints or potential challenges the company may face in the future.

Noise Level: 7

Justification: The article provides relevant information about Robinhood’s financial performance, including its narrowed loss and revenue growth. However, it lacks in-depth analysis of the reasons behind the decline in monthly active users and the impact of the planned cryptocurrency trading launch in the European Union. The article also does not provide any evidence or data to support its claims. Overall, the article contains some useful information but lacks depth and supporting evidence.

Financial Relevance: Yes

Financial Markets Impacted: Robinhood Markets

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article pertains to financial topics as it discusses the financial performance of Robinhood Markets, including its revenue growth and decline in key metrics such as monthly active users. However, there is no mention of any extreme event or its impact.

www.marketwatch.com

www.marketwatch.com