Stocks and commodities experience mixed performance in pre-market trading

- MicroStrategy Inc. and Coinbase Global Inc. lead pre-market trading with gains of 7.6% and 7.5% respectively

- S&P 500 futures down 0.37%, Dow Jones Industrial Average futures down 0.25%

- Brent crude oil futures down 0.56%, gold futures down 0.05%

- Bitcoin up 3.61% to $40,410

- 10-Year Treasury yield climbs to 4.254%

- S&P 500 and Dow Jones were up in the previous regular trading session

- Stocks in Asia and Europe down

MicroStrategy Inc. and Coinbase Global Inc. are leading pre-market trading with gains of 7.6% and 7.5% respectively. However, S&P 500 futures are down 0.37% and Dow Jones Industrial Average futures are down 0.25%. In commodities news, Brent crude oil futures are down 0.56% and gold futures are down 0.05%. On the other hand, Bitcoin is up 3.61% to $40,410 and the 10-Year Treasury yield has climbed to 4.254%. In the previous regular trading session, the S&P 500 and the Dow were up 0.59% and 0.82% respectively. Stocks in Asia, including Japan’s NIKKEI 225 Index and China’s Shanghai Composite Index, were down overnight. In Europe, the STOXX Europe 600 Index and the FTSE 100 Index are also experiencing declines. Stay updated with Barron’s for regular trading day updates.

Public Companies: MicroStrategy Inc. (MSTR), Coinbase Global Inc. (COIN), Science Applications International Corp. (SAIC), Carvana Co. Cl A (CVNA), Uber Technologies Inc. (UBER), dLocal Ltd. (DLO), AngloGold Ashanti PLC (AU)

Private Companies:

Key People:

Factuality Level: 8

Justification: The article provides factual information about the pre-market trading performance of various stocks, futures, and commodities. It also includes information about the previous regular trading session and the performance of stocks in Asia and Europe. The article does not contain any irrelevant or misleading information, sensationalism, redundancy, or opinion masquerading as fact. It does not include any bias or personal perspective. However, it could be improved by providing more context or analysis.

Noise Level: 2

Justification: The article is primarily focused on providing market updates and stock performance information. It does not provide any analysis, insights, or solutions. The information provided is repetitive and lacks depth. It also includes irrelevant information about stock markets in Asia and Europe, which is not directly related to the opening of U.S. stock markets.

Financial Relevance: Yes

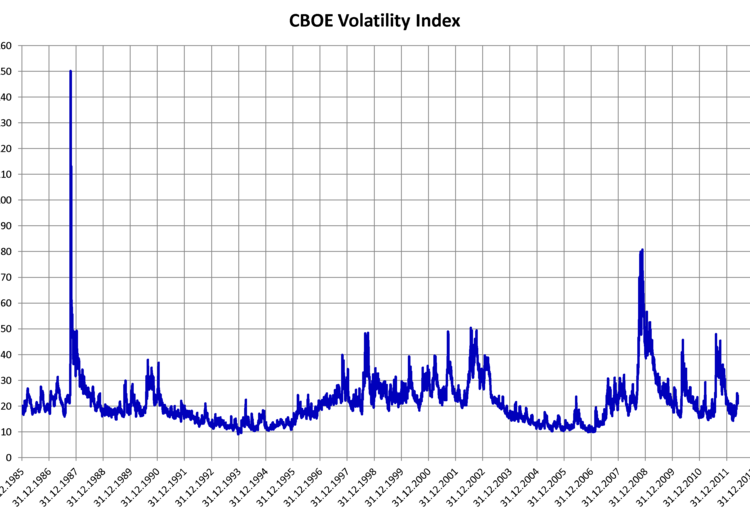

Financial Markets Impacted: The article provides information on the pre-market trading performance of several companies, including MicroStrategy Inc. (MSTR), Coinbase Global Inc. (COIN), Science Applications International Corp. (SAIC), Carvana Co. Cl A (CVNA), Uber Technologies Inc. (UBER), dLocal Ltd. (DLO), and AngloGold Ashanti PLC (AU). It also mentions the performance of S&P 500 futures, Dow Jones Industrial Average futures, Cboe Volatility Index futures, Brent crude oil futures, gold futures, Bitcoin, and the 10-Year Treasury yield.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article does not describe any extreme events. It solely focuses on the pre-market trading performance of various companies and provides updates on the performance of stock markets and commodities.

www.marketwatch.com

www.marketwatch.com