Merger with Amazon’s help aims to strengthen luxury retail against brand competition

- Saks Fifth Avenue’s parent company to acquire Neiman Marcus in a $2.65 billion deal

- Amazon to take a minority stake, providing tech and logistical expertise

- Salesforce to be a minority shareholder with AI assistance

- HBC financing the deal with support from Rhône Capital, Abu Dhabi Investment Council, and NRDC Equity Partners

- Apollo Global Management providing $1.15 billion in debt financing

- Saks’s e-commerce CEO Marc Metrick to run combined companies

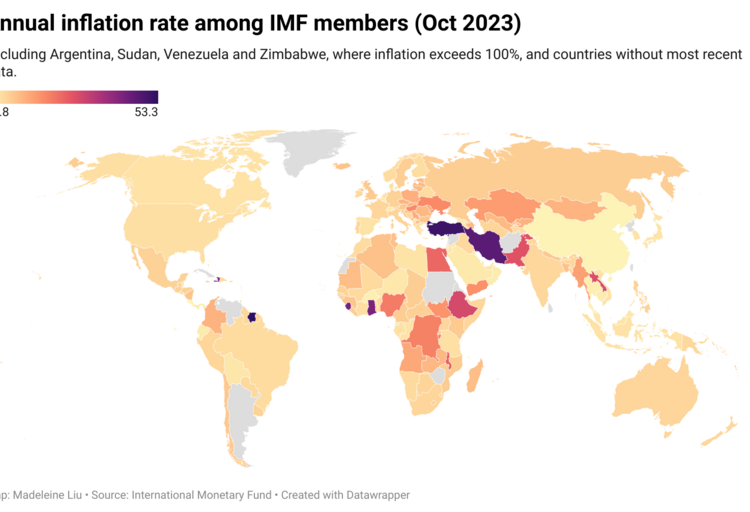

- Both chains have struggled with declining luxury goods sales amidst pandemic and inflation

- Luxury spending in Americas fell 8% in 2023 compared to 2022, while Asia and Europe saw growth

- Merger aims to negotiate better terms with suppliers and eliminate duplicate costs

- No plans to close stores post-merger

- Saks.com and Neiman’s e-commerce businesses to continue operating separately

The parent company of Saks Fifth Avenue is set to acquire rival Neiman Marcus in a $2.65 billion deal, creating a luxury retail powerhouse. Amazon will take a minority stake and provide technology and logistical support, while Salesforce assists with AI adoption. The combined company, named Saks Global, aims to negotiate better terms with suppliers and eliminate duplicate costs without closing stores. Both chains have faced challenges due to declining luxury goods sales amidst pandemic and inflation.

Sources: https://www.bloomberg.com/news/articles/2021-05-26/saks-inc-to-acquire-neiman-marcus-in-2-65-billion-deal-amidst-luxury-retail-struggles

Factuality Level: 2

Factuality Justification: The article contains irrelevant information about the Balmain x Barbie collection and details about the parent companies of Saks Fifth Avenue and Neiman Marcus. It lacks focus on the main topic of the acquisition deal between the two companies. The article also includes unnecessary background information and details that are tangential to the main news.·

Noise Level: 2

Noise Justification: The article provides detailed information about the $2.65 billion deal between the parent company of Saks Fifth Avenue and Neiman Marcus, including the background, financial details, stakeholders, and potential impact on the luxury retail industry. It also discusses the challenges faced by department stores and the strategies employed by the merged entity. The article stays on topic, supports its claims with data, and offers insights into the changing dynamics of luxury retail.·

Public Companies: Amazon (AMZN), Salesforce (null), Apollo Global Management (APO)

Private Companies: HBC,Rhône Capital,Abu Dhabi Investment Council,NRDC Equity Partners,Pacific Investment Management Co.,Davidson Kempner Capital Management,Sixth Street Partners

Key People: Marc Metrick (Chief Executive of Saks’s e-commerce business), Richard Baker (HBC’s Executive Chairman), Jack Baker (Son of Richard Baker), Bernard Arnault (LVMH CEO)

Financial Relevance: Yes

Financial Markets Impacted: The deal will impact luxury retailing and e-commerce companies, as well as the stock prices of Amazon, Salesforce, and Apollo Global Management.

Financial Rating Justification: This article discusses a $2.65 billion deal between Saks Fifth Avenue’s parent company and Neiman Marcus, creating a powerhouse in luxury retailing with assistance from Amazon and Salesforce. The merger will impact the luxury goods market and potentially affect the stock prices of related companies.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: ·

www.wsj.com

www.wsj.com  www.marketwatch.com

www.marketwatch.com