Sanofi diversifies product base and strengthens rare disease portfolio

- Sanofi plans to buy assets from Inhibrx in a deal worth up to $2.2 billion

- The acquisition aims to diversify Sanofi’s product base and boost its pipeline of rare disease treatments

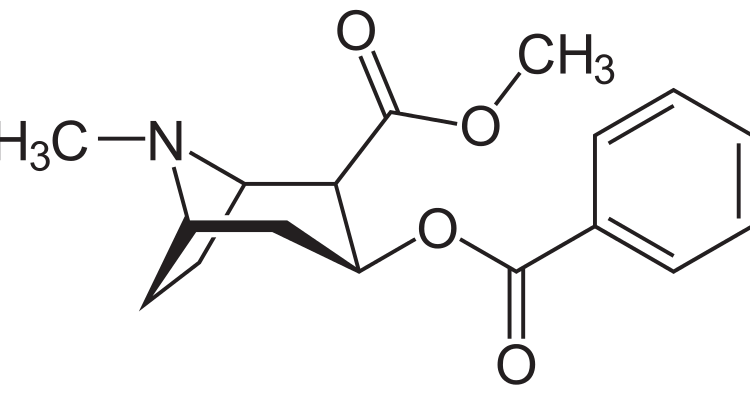

- Sanofi will acquire Inhibrx’s INBRX-101 therapy, a potential treatment for a genetic disorder

- The deal is part of Sanofi’s strategy to transition into a pure-play biopharmaceutical company

- The rest of Inhibrx’s assets and liabilities will be spun off into a new publicly traded company

- The acquisition is expected to be completed in the second quarter

Sanofi, the French pharmaceutical giant, has announced plans to acquire assets from biopharmaceutical company Inhibrx in a deal valued at up to $2.2 billion. The acquisition aims to diversify Sanofi’s product base and boost its pipeline of rare disease treatments. As part of its strategy to transition into a pure-play biopharmaceutical company, Sanofi will acquire Inhibrx’s INBRX-101 therapy, a potential treatment for a genetic disorder. The rest of Inhibrx’s assets and liabilities will be spun off into a new publicly traded company. The acquisition is expected to be completed in the second quarter.

Public Companies: Sanofi (SAN), Inhibrx (null), Johnson & Johnson (JNJ), Merck (MRK)

Private Companies:

Key People: Paul Hudson (Chief Executive), Houman Ashrafian (Head of Research and Development)

Factuality Level: 8

Justification: The article provides factual information about Sanofi’s plans to acquire assets from Inhibrx in a deal worth up to $2.2 billion. It mentions the specific therapy being acquired and the company’s strategy to diversify its product base and boost its pipeline of rare disease treatments. The article also mentions the CEO’s plans to transition the company into a pure-play biopharmaceutical company. The information about Sanofi’s current sales and its commitment to strengthening growth through clinical development is also factual. The article includes information about the deal structure and the expected completion timeline. The mention of recent acquisitions in the pharmaceutical industry is also accurate.

Noise Level: 7

Justification: The article provides information about Sanofi’s plan to acquire assets from Inhibrx, diversify its product base, and boost its pipeline of rare disease treatments. It mentions the CEO’s plans to transition the company into a pure-play biopharmaceutical company. The article also mentions Sanofi’s current sales from Dupixent and flu vaccines. However, it lacks in-depth analysis, scientific rigor, and evidence to support the claims made. It does not explore the consequences of the acquisition on those who bear the risks or provide actionable insights or solutions. Overall, the article contains relevant information but lacks depth and analysis.

Financial Relevance: Yes

Financial Markets Impacted: The acquisition of assets from Inhibrx by Sanofi may impact the financial markets and companies involved in the pharmaceutical industry.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses a financial transaction between Sanofi and Inhibrx, which has the potential to impact the financial markets and companies in the pharmaceutical industry. However, there is no mention of any extreme events.

www.marketwatch.com

www.marketwatch.com