Increasing transparency and recognizing the true cost of running a business

- SAP will treat share-based compensation as a regular expense starting in the new year

- The change will increase transparency in SAP’s financial reporting practices

- The new accounting will affect SAP’s first-quarter results in April

- SAP’s 2023 results will not reflect the change, but guidance for the new year will factor it in

- The move aims to recognize share-based compensation as a genuine expense of running a business

SAP has announced that it will start treating share-based compensation as a regular expense, beginning in the new year. This change is part of SAP’s efforts to increase transparency in its financial reporting practices. The inclusion of share-based compensation expenses in SAP’s non-IFRS results will have an impact on the company’s first-quarter results, which are set to be reported on April 22. However, the change will not be reflected in SAP’s 2023 results. The guidance for the new year, expected to be released on January 24, will take into account the new accounting. SAP’s Chief Financial Officer, Dominik Asam, stated that while including share-based compensation in adjusted earnings may be seen as a disadvantage compared to some peers, it is a necessary step to recognize share-based compensation as a genuine expense of running a business. In addition to this change, SAP will also be excluding gains or losses from equity investments from its non-IFRS results, and gains or losses from small divestments will be recognized as non-operating income or expenses. These updates aim to further increase the transparency of SAP’s operating results while reducing short-term noise and volatility.

Public Companies: SAP (SAP)

Private Companies:

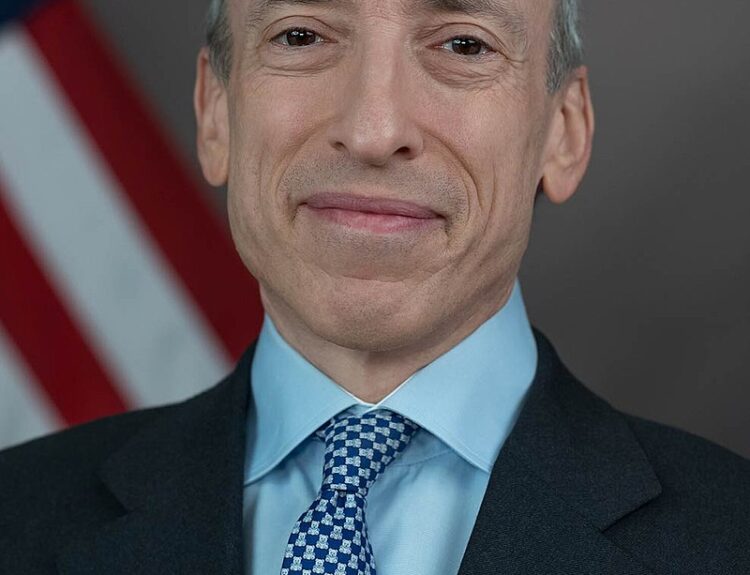

Key People: Dominik Asam (Chief Financial Officer)

Factuality Level: 8

Justification: The article provides factual information about SAP’s decision to include share-based compensation as a regular expense in its financial reporting practices. It quotes the Chief Financial Officer and provides details about the changes that will take effect in the new year. There is no obvious bias or opinion masquerading as fact in the article. However, it is a short news piece and lacks in-depth analysis or context.

Noise Level: 7

Justification: The article provides information about SAP’s decision to include share-based compensation as a regular expense in its financial reporting practices. It explains the reasons behind this change and how it will affect SAP’s results. The article also mentions other changes that will take effect in the new year. However, it lacks in-depth analysis and does not provide evidence or examples to support its claims. It also does not offer actionable insights or solutions. Overall, the article contains relevant information but lacks scientific rigor and intellectual honesty.

Financial Relevance: Yes

Financial Markets Impacted: The changes to SAP’s financial reporting practices may impact investor perception and analysis of the company’s operating results.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses changes to SAP’s financial reporting practices, specifically the inclusion of share-based compensation expenses in its non-IFRS results. While this is a significant change for SAP, it does not describe an extreme event or have a direct impact on financial markets or companies. However, it is relevant to financial topics as it pertains to financial reporting practices and transparency.

www.marketwatch.com

www.marketwatch.com