Examining the risks and oversight of profiting on price differences

- The basis trade in the Treasury market continues to draw scrutiny

- It involves profiting on price differences between Treasurys and Treasury futures

- The SEC is increasing oversight and requiring clearinghouse transactions

- The use of leveraged Treasury trades by hedge funds has raised concerns

- High U.S. interest rates have not deterred the use of the basis trade

- Rapid unwinding of the trade could be driven by forced selling or regulatory requirements

- Some argue that concerns about the basis trade are exaggerated

- Top players in the basis trade include Citadel, Tudor Investment Corp., and Balyasny Asset Management

The basis trade in the Treasury market, which involves profiting on the differences in prices between Treasurys and Treasury futures, continues to draw scrutiny. The Securities and Exchange Commission (SEC) is increasing oversight by requiring clearinghouse transactions, aiming to eliminate systemwide risk. The use of leveraged Treasury trades by hedge funds has raised concerns, with the Federal Reserve warning about market instability. Despite high U.S. interest rates, the basis trade remains popular. Rapid unwinding of the trade could be driven by forced selling or regulatory requirements. Some argue that concerns about the basis trade are exaggerated. Top players in the basis trade include Citadel, Tudor Investment Corp., and Balyasny Asset Management.

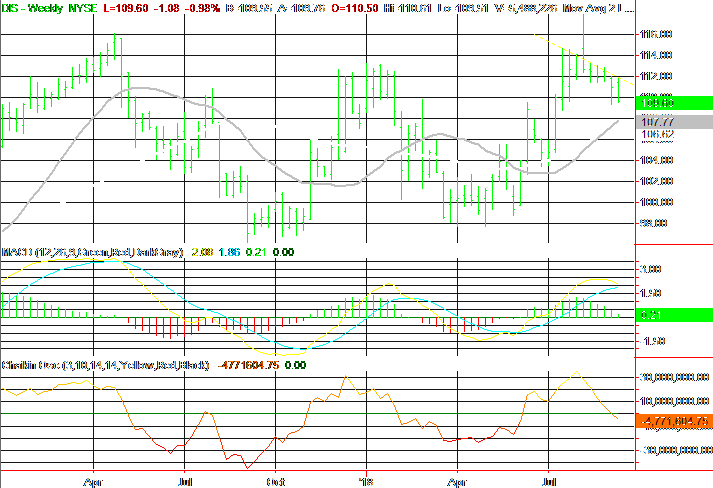

Public Companies: Deutsche Bank (DB)

Private Companies: undefined, undefined, undefined, undefined, undefined, undefined, undefined, undefined

Key People: Gary Gensler (Securities and Exchange Commission (SEC) Chairman), Steven Zeng (Strategist at Deutsche Bank), Ben Emons (Senior Portfolio Manager and Head of Fixed Income at NewEdge Wealth), Ken Griffin (Head of Citadel), Rostin Behnam (Chairman of the Commodity Futures Trading Commission)

Factuality Level: 7

Justification: The article provides information about the basis trade in the Treasury market and the scrutiny it is facing. It mentions the actions taken by the SEC and the Federal Reserve to address the risks associated with leveraged Treasury trades. It also includes perspectives from different individuals and organizations, some critical and some supportive of the basis trade. However, the article lacks in-depth analysis and may benefit from more context and expert opinions.

Noise Level: 3

Justification: The article provides information on the basis trade in the Treasury market and the scrutiny it is facing. It mentions the actions taken by the SEC and the Federal Reserve to address the risks associated with leveraged Treasury trades. It also includes perspectives from different stakeholders, including hedge funds, financial industry groups, and regulators. However, the article lacks in-depth analysis and evidence to support its claims. It also includes some irrelevant information about Treasury yields finishing little changed on a specific day.

Financial Relevance: Yes

Financial Markets Impacted: The article pertains to the Treasury market and the use of leverage in Treasury trades by hedge funds.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the basis trade in the Treasury market and the potential risks associated with leverage. While there is no mention of an extreme event, the use of leverage in financial markets can have significant implications for market stability and systemic risk.

www.marketwatch.com

www.marketwatch.com