Analysts weigh in on Snowflake’s performance and AI strategy

- Snowflake’s stock falls despite an improved full-year forecast for product revenue

- Bernstein expresses concerns about inflated investor expectations and unclear long-term strategy

- UBS analyst raises target price but maintains neutral rating due to potential customer migrations

- Evercore ISI analyst sees potential in AI products and core business growth

Snowflake Inc.’s latest earnings report showed an improved full-year forecast for product revenue, but some analysts remain cautious about the stock’s potential for a major rally. Bernstein’s Mark Moerdler expressed concerns over unclear long-term strategy and inflated expectations. UBS’s Karl Keirstead raised his target price while maintaining a neutral rating, citing possible customer migrations affecting usage growth. Evercore ISI’s Derrick Wood stayed bullish on the core business and AI products.

Factuality Level: 8

Factuality Justification: The article provides accurate information about Snowflake Inc.’s latest earnings report, analyst opinions, and their expectations for the company’s future. It includes quotes from different analysts with varying perspectives and mentions specific details such as price targets and ratings. However, it lacks a clear conclusion or summary of the overall sentiment towards the stock.

Noise Level: 6

Noise Justification: The article provides some relevant information about Snowflake’s latest earnings report and analyst opinions, but it also contains filler content such as mentions of text-to-speech technology and advertisements. It lacks in-depth analysis or new knowledge that the reader can apply.

Public Companies: Snowflake Inc. (SNOW)

Key People: Mark Moerdler (Analyst at Bernstein), Karl Keirstead (Analyst at UBS), Kirk Materne (Analyst at Evercore ISI), Derrick Wood (Analyst at TD Cowen)

Financial Relevance: Yes

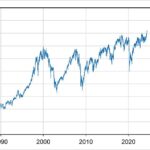

Financial Markets Impacted: Snowflake Inc.’s stock

Financial Rating Justification: The article discusses Snowflake Inc.’s latest earnings report, analyst opinions on its performance and growth potential, and the impact on its stock price. This is relevant to financial topics as it involves a company’s financial performance and its effect on investors and financial markets.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article. It discusses investor concerns and analyst opinions about Snowflake Inc.’s performance and growth potential.

www.marketwatch.com

www.marketwatch.com