Slowdown in solar installations leads to lower profits and sales

- SolarEdge cuts outlook for Q3 profits and gross margins

- Expects ‘significantly lower’ Q4 revenue

- Stock drops more than 15% in extended session

- Slowdown in solar-power installations in Europe

- Cancellations and pushouts due to higher-than-expected inventory and slower installation rates

- Adjusted guidance unrelated to Israel-Hamas war

- Third-quarter revenue expected to be between $720 million and $730 million

- Adjusted gross margins seen between 20.1% and 21.1%

- Adjusted operating income expected to be between $12 million and $31 million

- SolarEdge to report full Q3 results on Nov. 1

- Other solar power-related stocks also drop in after-hours trading

Factuality Level: 7

Justification: The article provides information about SolarEdge Technologies Inc. cutting its outlook for third-quarter profits and gross margins due to a slowdown in solar-power installations in Europe. It includes quotes from the company’s CEO and mentions that the slowdown is unrelated to the Israel-Hamas war. The article also provides information about SolarEdge’s revised revenue and margin expectations, as well as the impact on other solar power-related stocks. Overall, the article presents factual information without any obvious bias or misleading elements.

Noise Level: 3

Justification: The article provides relevant information about SolarEdge Technologies Inc. cutting its outlook for third-quarter profits and gross margins due to a slowdown in solar-power installations in Europe. It also mentions that the slowdown is unrelated to the Israel-Hamas war. The article includes specific numbers and quotes from SolarEdge’s CEO. However, it lacks in-depth analysis, scientific rigor, and actionable insights.

Financial Relevance: Yes

Financial Markets Impacted: Solar power-related stocks

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article pertains to the financial topic of SolarEdge Technologies Inc. cutting its outlook for third-quarter profits and gross margins due to a slowdown in solar-power installations in Europe. This news has impacted solar power-related stocks, such as Enphase Energy Inc. and SunPower Corp.

Public Companies: SolarEdge Technologies Inc. (SEDG), Enphase Energy Inc. (ENPH), SunPower Corp. (SPWR), Invesco Solar ETF (TAN)

Private Companies:

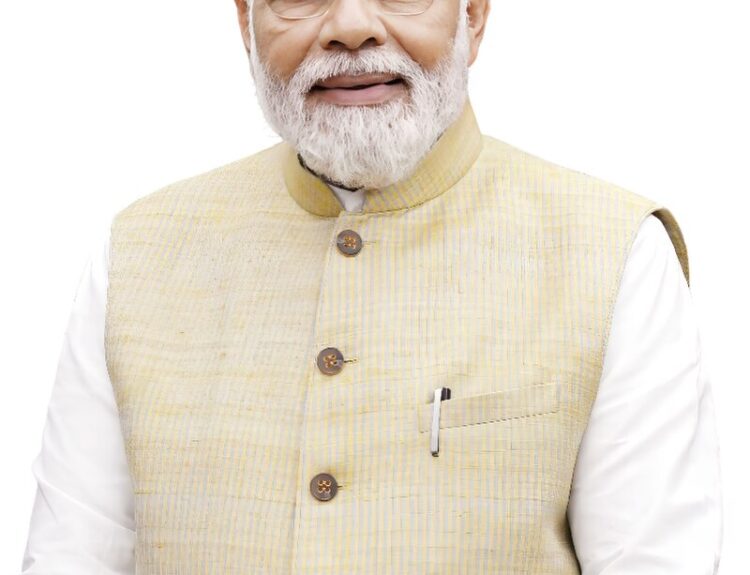

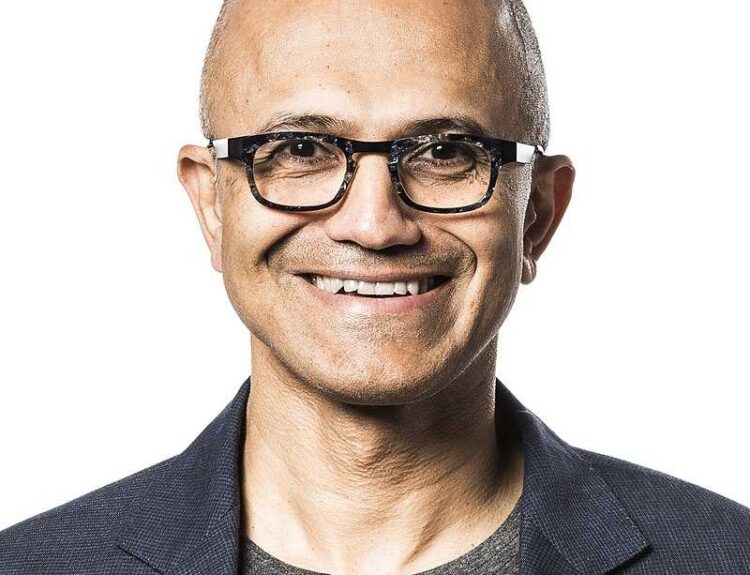

Key People: Zvi Lando (Chief Executive)

SolarEdge Technologies Inc. has revised its outlook for the third quarter, expecting lower profits and gross margins, as well as significantly lower revenue in the fourth quarter. The company attributes the slowdown to unexpected cancellations and pushouts from European distributors, which were caused by higher-than-expected inventory and slower installation rates. SolarEdge emphasizes that the adjusted guidance is unrelated to the Israel-Hamas war. The company expects third-quarter revenue to be between $720 million and $730 million, with adjusted gross margins between 20.1% and 21.1%. Adjusted operating income is projected to be between $12 million and $31 million. SolarEdge will release its full third-quarter results on November 1. The news of the guidance cut has also affected other solar power-related stocks, with Enphase Energy Inc. and SunPower Corp. seeing declines of 13% and 7% respectively in after-hours trading.