Stocks poised for further gains after best weekly performance in a year

- S&P 500 futures show stocks extending latest rally

- Stock-index futures trading higher

- S&P 500 rose 5.85% last week

- Bond yields dip, constraining equity bulls’ optimism

- Upcoming bond auctions and CPI release to be decisive

- Slow start to the week in terms of economic data

- Third quarter earnings season continues

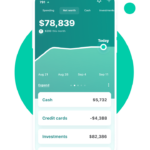

U.S. stock futures are showing a continuation of the latest rally, with S&P 500 futures trading higher. Last week, the S&P 500 recorded its best weekly gain in nearly a year, driven by comments from Federal Reserve Chairman Jay Powell and signs of a cooling labor market. Bond yields have dipped, but are picking back up, constraining equity bulls’ optimism. The upcoming bond auctions and CPI release will be decisive factors. Economic data is slow at the start of the week, with only the Federal Reserve’s senior loan officer survey scheduled for release. The third quarter earnings season continues, with NXP Semiconductors, Vertex Pharmaceuticals, and Tripadvisor set to release their results. Uber and Walt Disney are among the highlights for the week. Overall, the market remains positive, with a majority of S&P 500 companies delivering positive earnings surprises.

Factuality Level: 7

Factuality Justification: The article provides information about the performance of U.S. stock futures and the factors driving the market. It includes specific data on stock-index futures and the performance of major indices. The article also mentions comments from Federal Reserve Chairman Jay Powell and the impact on bond yields. However, the article lacks in-depth analysis and context, and it does not provide a balanced view of the market.

Noise Level: 3

Noise Justification: The article primarily focuses on stock futures and market performance, providing information on indices and yields. It briefly mentions the Federal Reserve and upcoming economic data. However, it lacks in-depth analysis, evidence, and actionable insights. The article is relatively short and does not dive into unrelated territories, but it lacks scientific rigor and intellectual honesty.

Financial Relevance: Yes

Financial Markets Impacted: U.S. stock futures

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the performance of U.S. stock futures and the impact of Federal Reserve policies on market sentiment. There is no mention of any extreme events or events that would significantly impact financial markets or companies.

Public Companies: NXP Semiconductors (NXPI), Vertex Pharmaceuticals (VRTX), Tripadvisor (TRIP), Uber (UBER), Walt Disney (DIS)

Key People: Jay Powell (Federal Reserve Chairman), Stephen Innes (Managing Partner at SPI Asset Management), Lisa Cook (Federal Reserve Governor), John Butters (Senior Earnings Analyst at Factset)

Reported publicly:

www.marketwatch.com

www.marketwatch.com