Stock-index futures indicate potential for new record

- S&P 500 futures just shy of record high

- Optimism that U.S. borrowing costs will fall in 2024

- Stock-index futures trading little changed

- Dow Jones Industrial Average futures fell 4 points

- Nasdaq 100 futures eased 2 points

- S&P 500 aiming for ninth consecutive week of gains

- Investors hopeful of a soft landing and reduced borrowing costs

- Positive return to trading after Christmas break

- Hong Kong and mainland China markets buoyed by rebound in gaming stocks

- Traders keeping an eye on oil market for potential inflationary pressures

U.S. stock index futures are indicating that the S&P 500 will open just shy of a fresh record high, driven by optimism that U.S. borrowing costs will fall in 2024. The Dow Jones Industrial Average and Nasdaq 100 futures are also trading little changed. The S&P 500 is aiming for its ninth consecutive week of gains, fueled by investor hopes of a soft landing and reduced borrowing costs. Markets have seen a positive return to trading after the Christmas break, with Hong Kong and mainland China markets buoyed by a rebound in gaming stocks. Traders are keeping a close eye on the oil market for any signs of potential inflationary pressures.

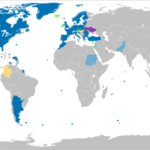

Public Companies: S&P 500 (SPX), Dow Jones Industrial Average (DJIA), Nasdaq Composite (COMP), U.K. (UK:UKX), Germany (DX:DAX), Australia (AU:XJO), Hong Kong (HK:HSI), China (CN:SHCOMP), Swissquote Bank ()

Private Companies:

Key People: Stephen Innes (), Ipek Ozkardeskaya (Senior Analyst)

Factuality Level: 7

Justification: The article provides information about the performance of U.S. stock index futures and the factors driving the markets. It includes specific data on the performance of S&P 500 futures, Dow Jones Industrial Average futures, and Nasdaq 100 futures. The article also mentions the recent performance of the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite. It discusses investor optimism regarding falling inflation and potential reduction in borrowing costs by the Federal Reserve. The article also mentions the positive return to trading by markets that were closed for Christmas break and the rebound of gaming stocks in Hong Kong and mainland China. However, the article lacks in-depth analysis and context, and it does not provide a comprehensive view of the overall market conditions.

Noise Level: 3

Justification: The article primarily focuses on stock market futures and their potential impact on the S&P 500. It provides some information on market performance and investor sentiment, but it lacks depth and analysis. The article also briefly mentions other global markets and oil prices, but these topics are not explored in detail. Overall, the article contains some relevant information but lacks in-depth analysis and actionable insights.

Financial Relevance: Yes

Financial Markets Impacted: U.S. stock market

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the performance of U.S. stock index futures and the potential for the S&P 500 to reach a new record high. There is no mention of any extreme events or events that would significantly impact financial markets or companies.

www.marketwatch.com

www.marketwatch.com