Market volatility and upcoming economic data in focus

- S&P 500 futures bounce back after worst one-day slide in three months

- Dow Jones Industrial Average futures up 0.4%

- S&P 500 futures gain 0.5%

- Nasdaq-100 futures increase 0.6%

- Worst one-day decline in S&P 500 since Sept. 26

- No clear fundamental trigger for sell-off

- Market has been rallying hard and fast

- Upcoming economic data releases

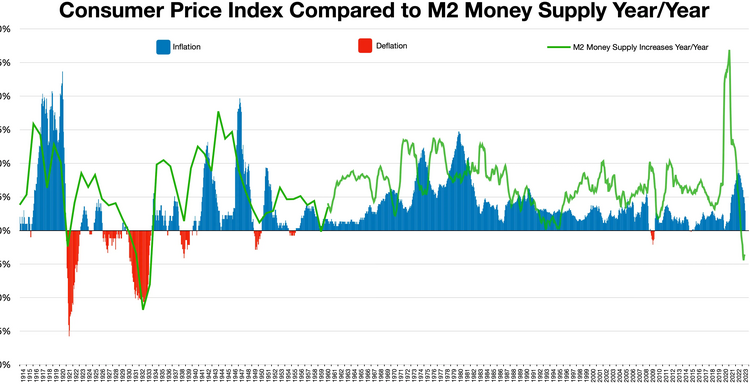

U.S. stock futures are set to open higher on Thursday, recovering from the worst one-day decline in three months. Dow Jones Industrial Average futures are up 0.4%, S&P 500 futures have gained 0.5%, and Nasdaq-100 futures have increased by 0.6%. Wednesday’s sell-off, which saw the S&P 500 experience its worst one-day decline since September 26, had no clear fundamental trigger. However, the market has been rallying strongly this year, with the S&P 500 up 22%. Economic data releases, including the PCE price index, weekly jobless claims, third-quarter GDP estimate, Philadelphia Fed manufacturing index, and leading economic index, are expected to provide further insight into the state of the economy. Micron Technology will also be in focus after reporting better-than-expected results.

Public Companies: Dow Jones Industrial Average (DJIA), S&P 500 (SPX), Nasdaq Composite (COMP), Micron Technology (MU)

Private Companies:

Key People:

Factuality Level: 7

Justification: The article provides factual information about the performance of U.S. stock futures and the previous day’s decline in the stock market. It also mentions the lack of a clear trigger for the sell-off and provides quotes from a Deutsche Bank strategist. However, the article lacks in-depth analysis and context, and it includes unnecessary information about upcoming economic data and a specific company’s results.

Noise Level: 3

Justification: The article provides some relevant information about the stock market and the recent decline, but it lacks depth and analysis. It mainly focuses on the market numbers and doesn’t provide any insights or explanations for the decline. The article also includes unrelated information about text-to-speech technology and asks for feedback, which is irrelevant to the topic.

Financial Relevance: Yes

Financial Markets Impacted: U.S. stock futures

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the performance of U.S. stock futures and the previous day’s decline in the stock market. There is no mention of any extreme events or significant impacts on financial markets or companies.

www.marketwatch.com

www.marketwatch.com