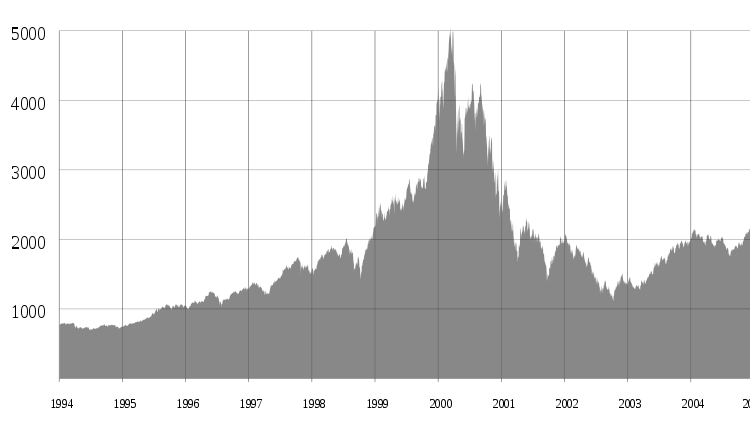

Will the stock market break out of its trading range?

- S&P 500 trading above its last record close

- New intraday record high set

- Choppy start to the year attributed to rise in Treasury yields and uncertainty over interest-rate cut

- Longest stretch without all-time closing high since 2007

- Short-term trading range for S&P 500

- Technical evidence suggests possible pullback or correction

- Return to record territory historically leads to positive returns

- U.S. stocks higher on Friday

The S&P 500 has once again reached a new record high, trading above its previous close and setting a new intraday high. This comes after a month of choppy trading, driven by rising Treasury yields and uncertainty over an interest-rate cut. If the index ends above the record close, it will break the longest stretch without an all-time high since 2007. However, technical indicators suggest a possible pullback or correction in the near future. Despite this, historical data shows that a return to record territory often leads to positive returns. U.S. stocks were higher on Friday, with the S&P 500, Dow Jones, and Nasdaq Composite all showing gains.

Public Companies: S&P 500 (SPX), Taiwan Semiconductor Manufacturing Co. (TSM)

Private Companies:

Key People: Mark Arbeter (President of Arbeter Investments LLC), Ed Clissold (Strategist at Ned Davis Research), London Stockton (Strategist at Ned Davis Research)

Factuality Level: 7

Justification: The article provides factual information about the S&P 500 index reaching a new intraday record high and potentially ending above its previous record closing high. It also mentions the reasons for the recent volatility in the stock market and includes quotes from analysts. However, there are some tangential details and repetitive information that could be considered irrelevant.

Noise Level: 6

Justification: The article provides information on the S&P 500 reaching a new record high and the factors that have influenced its performance. It includes data and quotes from analysts. However, it lacks in-depth analysis of long-term trends or antifragility and does not provide actionable insights or solutions.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the performance of the S&P 500 index and its potential impact on the stock market.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article primarily focuses on the performance of the S&P 500 index and the factors influencing it, without mentioning any extreme events or their impacts.

www.marketwatch.com

www.marketwatch.com