Key stock movements and earnings reports to watch

- JetBlue stock rising 14% after Carl Icahn discloses 9.9% stake

- Arm Holdings down 2.7% after significant gain on Monday

- ZoomInfo Technologies surging 25% after beating earnings and revenue estimates

- Tripadvisor shares jumping 14% after forming special committee for potential transaction

- Arista Networks beats earnings estimates, stock declines 6.3%

- Cadence Design Systems falls 7% after missing earnings guidance

- Lattice Semiconductor posts lower revenue, shares down 8%

- WM (Waste Management) rises 2.6% after beating earnings forecasts

- Coca-Cola expected to report fourth-quarter earnings

Stock futures fell ahead of the release of U.S. inflation data for January. JetBlue stock rose 14% after Carl Icahn disclosed a 9.9% stake. Arm Holdings was down 2.7% after a significant gain on Monday. ZoomInfo Technologies surged 25% after beating earnings and revenue estimates. Tripadvisor shares jumped 14% after forming a special committee for potential transactions. Arista Networks beat earnings estimates, but the stock declined 6.3%. Cadence Design Systems fell 7% after missing earnings guidance. Lattice Semiconductor posted lower revenue, and shares were down 8%. WM (Waste Management) rose 2.6% after beating earnings forecasts. Coca-Cola is expected to report fourth-quarter earnings.

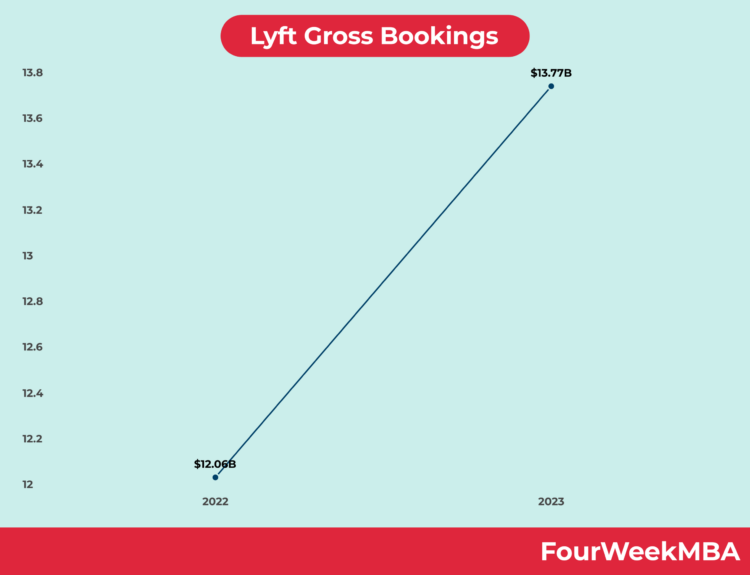

Public Companies: JetBlue (JBLU), Arm Holdings (ARMH), ZoomInfo Technologies (ZI), Tripadvisor (TRIP), Arista Networks (ANET), Cadence Design Systems (CDNS), Lattice Semiconductor (LSCC), WM (Waste Management) (WM), Coca-Cola (KO), Shopify (SHOP), Airbnb (ABNB), Zoetis (ZTS), Marriott International (MAR), Datadog (DDOG), Biogen (BIIB), GlobalFoundries (GFS), Akamai Technologies (AKAM), Hasbro (HAS), MGM Resorts (MGM), Zillow (Z), Robinhood Markets (HOOD), Lyft (LYFT)

Private Companies:

Key People: Carl Icahn (Activist)

Factuality Level: 7

Justification: The article provides information about stock futures falling ahead of the release of U.S. inflation data for January. It also includes details about specific stocks and their performance. The information seems to be based on economists’ expectations and company reports. However, there is no indication of any bias or personal perspective, and the information provided is relevant to the topic.

Noise Level: 3

Justification: The article is primarily a list of stock market updates and earnings reports. It lacks thoughtful analysis, antifragility, and accountability. It also does not provide evidence or actionable insights.

Financial Relevance: Yes

Financial Markets Impacted: The stock futures fell ahead of the release of U.S. inflation data, indicating potential market volatility.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article pertains to financial topics as it discusses stock futures and earnings reports of various companies. However, there is no mention of any extreme events or their impact.

www.marketwatch.com

www.marketwatch.com