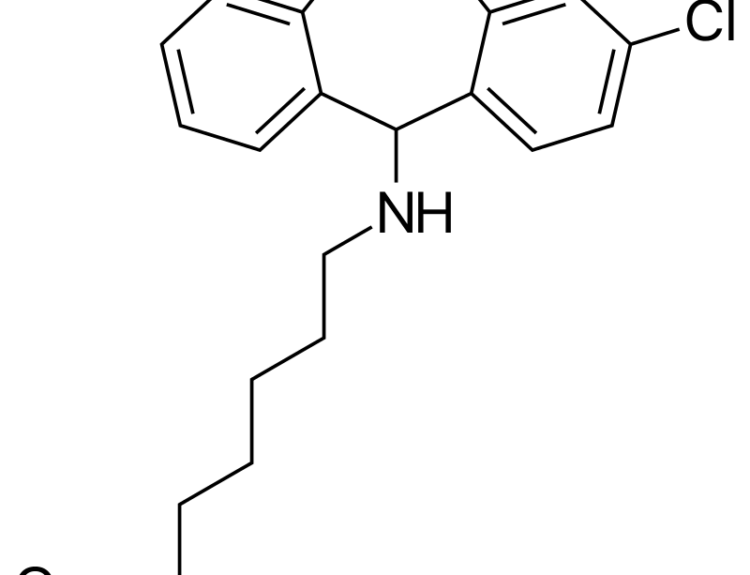

Blank-check company aims to merge with growth companies in healthcare

- TechyBird SPAC files for $60 million IPO

- Targeting biotechnology and pharmaceutical sectors

- Plans to offer 6 million units for $10 each

- Proceeds to go into a trust account for business combination

- Shares expected to trade on Nasdaq Global Market

TechyBird Acquisition Corp., a special-purpose acquisition company, has filed for an initial public offering (IPO) with the Securities and Exchange Commission. The company is targeting the biotechnology and pharmaceutical sectors, with a focus on growth companies valued between $100 million and $2 billion. TechyBird plans to offer 6 million units for $10 each, with proceeds going into a trust account for a future business combination. The company expects its shares to trade on the Nasdaq Global Market under the ticker TKBD. The offering provides TechyBird with one year to complete an initial business combination, with the possibility of a 12-month extension by depositing additional funds into its trust account.

Factuality Level: 8

Factuality Justification: The article provides factual information about TechyBird Acquisition Corp. filing for an initial public offering with the Securities and Exchange Commission. It includes details about the number of units being offered, the target sectors, and the expected trading platform. The article also mentions the intended use of proceeds and the timeline for completing a business combination. Overall, the article presents information without any obvious bias or inaccuracies.

Noise Level: 7

Noise Justification: The article provides basic information about TechyBird Acquisition Corp.’s initial public offering and its plans to pursue a business combination in the biotechnology and pharmaceutical sectors. However, it lacks in-depth analysis, scientific rigor, and intellectual honesty. It does not explore the consequences of the company’s decisions on those who bear the risks, nor does it provide actionable insights or solutions. The article stays on topic and supports its claims with information about the company’s filing and plans. Overall, the article contains some relevant information but lacks depth and critical analysis.

Financial Relevance: Yes

Financial Markets Impacted: The filing for an initial public offering by TechyBird Acquisition Corp. may impact the financial markets, particularly the biotechnology and pharmaceutical sectors.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The news article pertains to financial topics as it discusses TechyBird Acquisition Corp.’s filing for an initial public offering. While there is no mention of an extreme event, the information provided is relevant to financial markets and companies in the biotechnology and pharmaceutical sectors.

Public Companies: TechyBird Acquisition Corp. (TKBD)

Key People:

Reported publicly:

www.marketwatch.com

www.marketwatch.com