Merchants demand fairness as Temu’s success comes at their expense.

- Temu suppliers protest against unfair penalties imposed by the platform.

- Merchants claim penalties have led to bankruptcies and significant debts.

- Temu’s policies are designed to ensure high customer service and quality.

- Suppliers report a lack of transparency and documentation regarding penalties.

- Hundreds of suppliers have formed online groups to discuss their grievances.

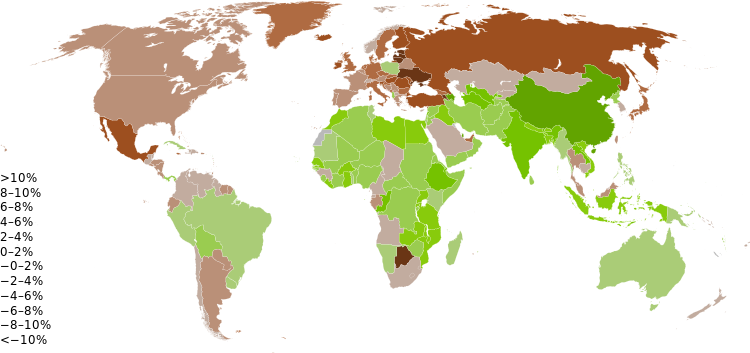

- Temu has rapidly grown to 234 million users in over 70 countries.

Temu, the popular shopping app backed by PDD Holdings, has seen explosive growth globally, attracting hundreds of millions of customers with its low prices. However, this success has sparked protests among Chinese suppliers who claim that the platform’s penalty system is driving them into bankruptcy. Recently, a large group of merchants gathered at a Temu affiliate’s office in Guangzhou to voice their frustrations over hefty penalties related to after-sales issues, which they argue are unfair and poorly documented. nnThese penalties, which can amount to five times the shipment price, are imposed when Temu finds fault with products or when customers request refunds. Suppliers like Xiang Shihua, a garment factory owner, have reported significant financial losses and mounting debts since they began supplying Temu. Many suppliers feel trapped by the platform’s policies, which they say lack transparency and do not allow for appeals. nnDespite Temu’s claims that its policies ensure high-quality service, suppliers argue that they are the ones suffering the consequences. They have formed online groups to share their experiences and have staged protests to demand better treatment. As Temu continues to expand, the tension between the platform and its suppliers raises questions about the sustainability of its business model and the impact on small businesses.·

Factuality Level: 7

Factuality Justification: The article provides a detailed account of the protests by suppliers against Temu, including specific quotes and perspectives from affected merchants. However, it does contain some bias in favor of the suppliers’ perspective without adequately presenting Temu’s side beyond a few statements. While the reporting is generally accurate, the lack of comprehensive context regarding Temu’s policies and the potential reasons behind them slightly detracts from its overall objectivity.·

Noise Level: 8

Noise Justification: The article provides a detailed account of the protests by Temu suppliers, highlighting their grievances and the impact of Temu’s policies on their businesses. It includes direct quotes from affected merchants, which adds credibility and personalizes the issue. The article stays on topic, offers insights into the challenges faced by suppliers, and holds Temu accountable for its practices. However, it could benefit from a deeper analysis of the broader implications of these events.·

Public Companies: PDD Holdings (PDD)

Private Companies: Temu

Key People: Xiang Shihua (Garment-factory owner), Ke Ling (Temu supplier), Clarence Leong (Contributor)

Financial Relevance: Yes

Financial Markets Impacted: Chinese e-commerce companies and suppliers

Financial Rating Justification: The article discusses the impact of Temu, a Chinese e-commerce company backed by PDD Holdings, on its suppliers and how it has affected their businesses. This has implications for the financial performance of these suppliers and the overall e-commerce market in China.

Presence Of Extreme Event: Yes

Nature Of Extreme Event: Political Crisis

Impact Rating Of The Extreme Event: Moderate

Extreme Rating Justification: The protests by suppliers against Temu indicate significant unrest and dissatisfaction among a large group of people, which can be classified as a political crisis. The impact is rated as moderate due to the economic consequences for the suppliers, including bankruptcies and debts, but it does not appear to have resulted in widespread violence or severe disruption.·

www.wsj.com

www.wsj.com