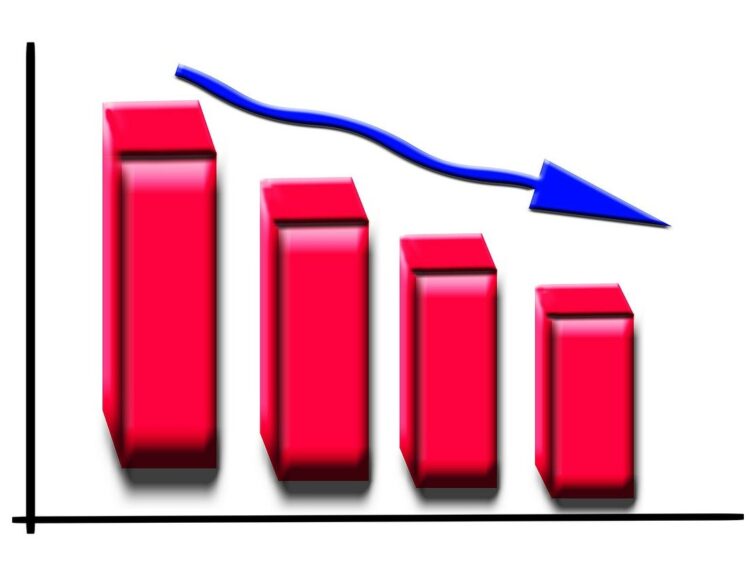

Investors anticipate interest rate cuts as inflation subsides

- 10-year Treasury yields trade near five-month lows

- Investors betting on easing inflation and potential interest rate cuts

- Yield on 10-year Treasury falls to 3.873%

- Markets pricing in possibility of rate cut in March 2024

U.S. bond yields fell as investors bet on easing inflation and potential interest rate cuts by the Federal Reserve. The yield on the 10-year Treasury dropped to 3.873%, trading near five-month lows. This comes as inflation has eased to 3.1% in November, creating a pathway for central banks to ease off on restrictive policies. Markets are pricing in the possibility of a rate cut in March 2024, with the Fed’s main rate expected to be at least down to a range of 3.75% to 4.0% by December 2024.

Public Companies: SPI Asset Management (N/A)

Private Companies:

Key People: Stephen Innes (Managing Partner at SPI Asset Management)

Factuality Level: 8

Justification: The article provides factual information about the movement of U.S. bond yields and the market’s expectations for inflation and interest rates. It includes quotes from a managing partner at SPI Asset Management and references the CME FedWatch tool for market probabilities. The article does not contain any irrelevant or misleading information, sensationalism, redundancy, or opinion masquerading as fact.

Noise Level: 7

Justification: The article provides information on bond yields and the factors driving the market. It mentions the current yield on different Treasury bonds and explains that investors are betting on inflation easing and the Federal Reserve cutting interest rates in 2024. The article also includes quotes from experts and mentions market expectations for future interest rate changes. However, it lacks in-depth analysis, evidence, and actionable insights.

Financial Relevance: Yes

Financial Markets Impacted: U.S. bond market

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the movement of U.S. bond yields and the market’s expectation of the Federal Reserve cutting interest rates in 2024. This information is relevant to financial markets and investors.

www.marketwatch.com

www.marketwatch.com