Understanding the intersection of geopolitics and markets

- Daleep Singh, former global chief economist of PGIM Fixed Income, is returning to his former government job

- Singh discusses the intersection of geopolitics and markets

- Five big forces driving the current state of geopolitics: intensification of great-power conflict, political polarization, transition to renewables, reorientation of supply chains, and migration away from a single market for technology

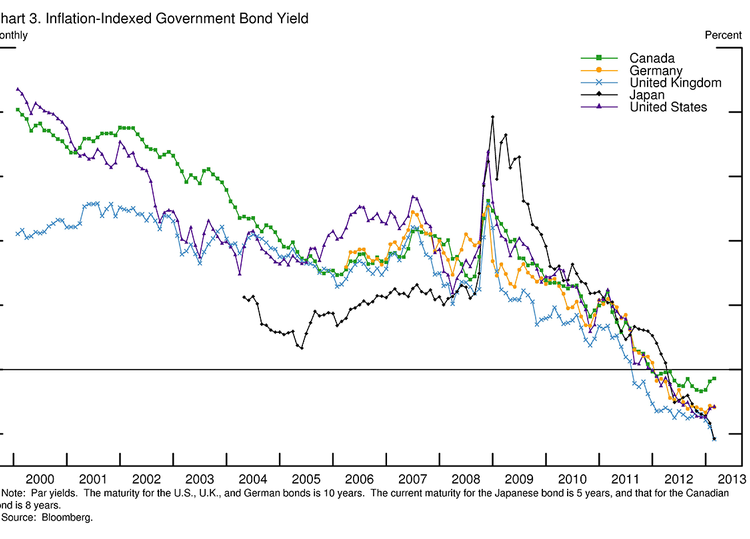

- These forces are leading to higher-trend inflation, higher-trend growth, higher volatility, higher risk premiums, and higher interest rates

- The role of government and fiscal spending in addressing the challenges of the world

- Uncertainties in investing in bonds and the impact on interest rates

- The complexity of processing global changes for central banks

- The weaponization of fossil energy and efforts to regain bargaining power

- Expectation of more efforts to regulate market power in the future

Daleep Singh, former global chief economist of PGIM Fixed Income, is returning to his former government job after being involved in the response to Russia’s invasion of Ukraine. In a recent interview, Singh discussed the intersection of geopolitics and markets, highlighting five big forces driving the current state of geopolitics: intensification of great-power conflict, political polarization, transition to renewables, reorientation of supply chains, and migration away from a single market for technology. These forces are leading to higher-trend inflation, higher-trend growth, higher volatility, higher risk premiums, and higher interest rates. Singh also emphasized the role of government and fiscal spending in addressing the challenges of the world, as well as the uncertainties in investing in bonds and the impact on interest rates. He acknowledged the complexity of processing global changes for central banks and the weaponization of fossil energy, with efforts to regain bargaining power. Singh expects more efforts to regulate market power in the future.

Factuality Level: 7

Factuality Justification: The article provides information about Daleep Singh’s return to his former government job and his involvement in the response to Russia’s invasion of Ukraine. It also includes insights from Singh about geopolitics and markets. However, the article lacks specific details and context for some statements, and there is no independent verification of the information provided.

Noise Level: 6

Noise Justification: The article provides some relevant information about Daleep Singh’s return to his former government job and his involvement in the response to Russia’s invasion of Ukraine. However, there is also some filler content, such as the mention of text-to-speech technology and the request for feedback on the feature. The article does not provide a thoughtful analysis of long-term trends or antifragility, and it does not hold powerful people accountable or explore the consequences of decisions. Overall, the article is somewhat informative but lacks depth and relevance.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the intersection of geopolitics and markets, highlighting the impact of geopolitical forces on financial markets and the need for government intervention in times of crisis. It also mentions the role of Treasury markets and the uncertainties surrounding government debt.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article primarily focuses on the role of Daleep Singh, a former government official and current economist, in shaping global economic strategy and his insights on the current state of geopolitics and financial markets. While it mentions the response to Russia’s invasion of Ukraine, there is no mention of any extreme events or their impact.

Public Companies: PGIM (N/A)

Private Companies: Barron’s

Key People: Daleep Singh (Global Chief Economist of PGIM Fixed Income)

www.marketwatch.com

www.marketwatch.com