Why six-figure earners are feeling the pinch in today’s economy

- HENRYs (High Earners, Not Rich Yet) face financial pressure despite high incomes.

- Rising costs of living, including housing and education, diminish the buying power of six-figure earners.

- Many HENRYs struggle with significant debt, including student loans.

- Lifestyle inflation leads to overspending, making it harder to feel financially secure.

- Private school tuition and childcare costs are major financial burdens for families.

- The gap between income and perceived financial comfort is growing for many Americans.

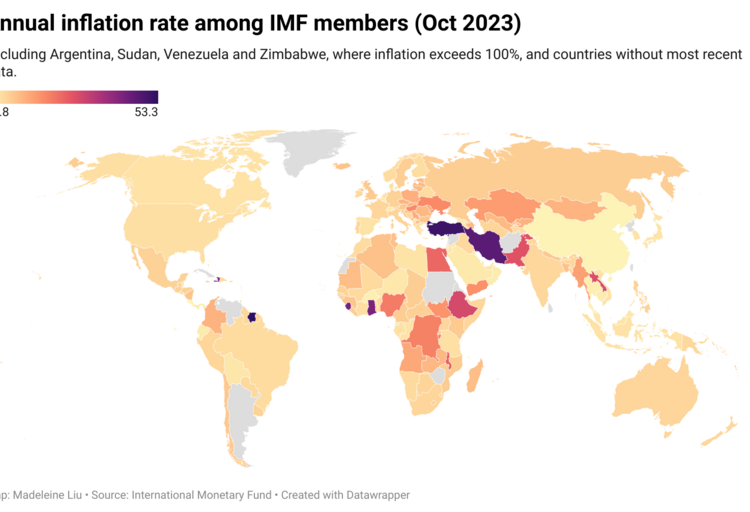

Fifteen years ago, April Little envisioned a stress-free life earning $300,000 a year, but reality hit hard when she realized that high income comes with high expenses. As a human-resources executive turned career coach in Rochester, N.Y., she finds herself burdened with $90,000 in student debt and the costs of raising three children. Many Americans like her, classified as HENRYs (High Earners, Not Rich Yet), are experiencing similar financial pressures despite their substantial salaries. nnRecent census data reveals that 14.4% of U.S. households earn $200,000 or more annually, yet many of these earners feel trapped in a cycle of financial stress. Rising prices for essentials like housing and childcare are outpacing income growth, leaving HENRYs feeling like they are running in place on a hamster wheel. nnAttorney Joshua Siegel, who drives a Lexus SUV, expected to own a home and enjoy country club memberships by now. Instead, he finds himself renting and struggling to keep up with the high cost of living in Los Angeles while raising three kids. Similarly, financial consultant Monique So, despite a net worth in the mid-seven figures, feels a scarcity mindset due to the high costs of daycare and other expenses. nnCaitlin Frederick, a financial planner, notes that many of her clients, particularly millennials, are realizing that their high salaries do not translate into financial security. They are facing skyrocketing costs for housing, cars, and childcare, which have all increased significantly over the past decade. nnFor many HENRYs, private school tuition has become a major financial strain, with nearly half of American private schools increasing enrollment recently. Families like Brad Gyger’s prioritize education for their children over luxury items, leading to a more modest lifestyle than their income might suggest. nnIn conclusion, the HENRY experience highlights a growing disconnect between income and financial comfort, as high earners grapple with the reality of rising living costs and the pressures of maintaining a certain lifestyle.·

Factuality Level: 7

Factuality Justification: The article provides a detailed account of the financial struggles faced by high earners, supported by personal anecdotes and statistics. However, it includes some subjective opinions and emotional appeals that may detract from its objectivity. While it presents relevant information, the narrative style and focus on individual experiences may lead to a perception of bias.·

Noise Level: 7

Noise Justification: The article provides a thoughtful analysis of the financial struggles faced by high earners, exploring the concept of HENRYs and the gap between income and perceived wealth. It includes personal anecdotes and data to support its claims, while also addressing broader economic trends. However, it could benefit from a deeper exploration of systemic issues and solutions, which prevents it from achieving a higher rating.·

Private Companies: Albrecht Law,Ullmann Wealth Partners

Key People: April Little (human-resources executive turned career coach), Joshua Siegel (partner and chair of the transactional tax group), Monique So (financial consultant), Caitlin Frederick (director of financial planning), Brad Gyger (independent sales consultant), Nabila Haq (not specified)

Financial Relevance: Yes

Financial Markets Impacted: Yes

Financial Rating Justification: The article discusses the financial struggles of high earners, specifically those categorized as HENRYs (high earners, not rich yet), highlighting issues such as rising costs of living, education expenses, and the impact of inflation on purchasing power. It mentions the financial markets indirectly by referencing the rising prices of homes and cars, which are influenced by market conditions. The article also touches on the financial planning aspects for individuals with high incomes but significant expenses, indicating a broader impact on consumer behavior and financial markets.·

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: The article discusses the financial struggles of high earners in the U.S. but does not mention any extreme event that occurred in the last 48 hours.·

Move Size: No market move size mentioned.

Sector: All

Direction: Down

Magnitude: Large

Affected Instruments: No

www.wsj.com

www.wsj.com