Is it time to consider adding trend-following strategies to your portfolio?

- Trend-following hedge funds have more than doubled the gains of the S&P 500 this year

- Trend-following funds continued strong performance in April despite stock market selloff

- Trend-following funds benefit from trends in currencies, commodities, and bonds

- Société Générale trend-following index finished April up 2%

- Trend-following funds up 14.5% year-to-date, their strongest start since last year

- Trend-following funds saw huge gains in 2022 but lackluster performance in 2023

- Trend-following funds on track to outperform in 2024 due to consistent market moves

- Trend-following strategies provide diversification and hedge against weakness in stocks

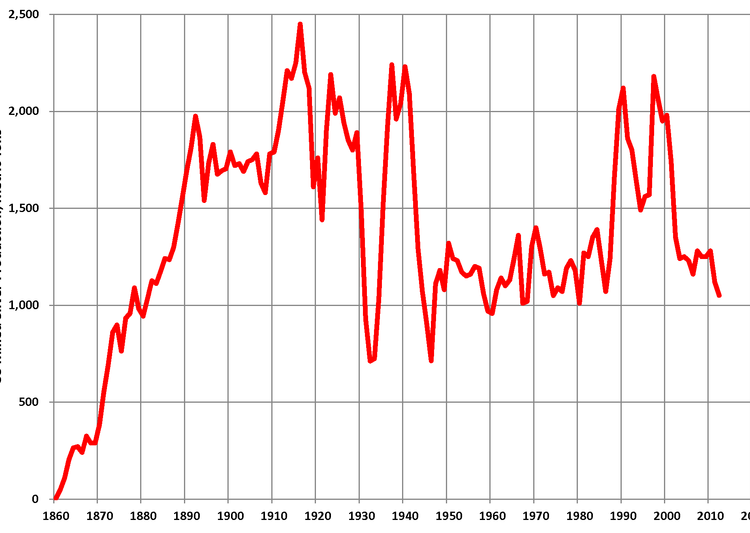

- Trend-following funds have outperformed the 60-40 portfolio over the long term

- Adding exposure to trend-following strategies can compensate for stock-bond correlation

Trend-following hedge funds have had a strong start in 2024, with gains that have more than doubled those of the S&P 500. Despite a stock market selloff in April, trend-following funds continued to perform well, benefiting from trends in currencies, commodities, and bonds. The Société Générale trend-following index finished April up 2%, widening its outperformance against the S&P 500 and a 60-40 basket of U.S. stocks and bonds. Year-to-date, trend-following funds are up 14.5%, their strongest start since last year. While they saw huge gains in 2022, their performance was lackluster in 2023. However, in 2024, they are once again on track to outperform as markets have moved consistently in a given direction. Trend-following strategies provide diversification and act as a hedge against weakness in stocks. They have a long-term record of outperforming the 60-40 portfolio and have zero long-term correlation to traditional assets. Adding exposure to trend-following strategies can help compensate for the correlation between stocks and bonds.

Factuality Level: 3

Factuality Justification: The article provides a detailed overview of trend-following funds’ performance in April and over the past few years. It includes data from Société Générale and Dow Jones Market Data to support its claims. However, the article lacks depth in analyzing potential risks or drawbacks of trend-following strategies, and it presents a somewhat one-sided view of their benefits.

Noise Level: 3

Noise Justification: The article provides a detailed analysis of trend-following funds’ performance, supported by data from Société Générale and Dow Jones Market Data. It explores the reasons behind the funds’ success in April, their historical performance, and the potential benefits of adding exposure to trend-following strategies in a portfolio. The article stays on topic and supports its claims with evidence and examples. However, it contains some repetitive information and could benefit from more diverse perspectives or counterarguments.

Financial Relevance: Yes

Financial Markets Impacted: Trend-following funds and their performance

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the performance of trend-following funds in the financial markets, specifically in relation to stocks, bonds, currencies, and commodities. There is no mention of any extreme events or their impact.

Public Companies: Société Générale (EPA:GLE), Man Group (LON:EMG)

Private Companies: Aspect Capital

Key People: Chris Reeve (Director of Risk at Aspect Capital)

Reported publicly:

www.marketwatch.com

www.marketwatch.com