Hurricane Watch Issued for Louisiana Coast

- U.S. oil prices rise due to Tropical Storm Francine’s potential impact on Gulf operations

- China adding to strategic oil reserve supports prices

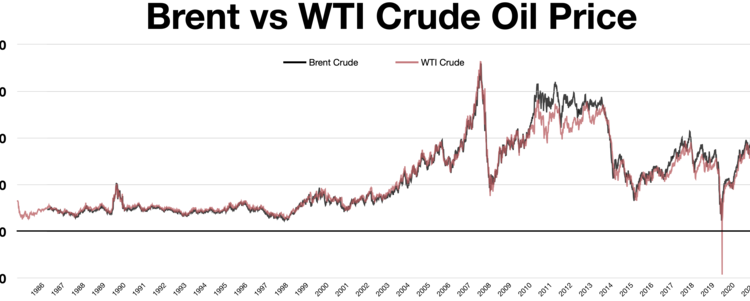

- WTI crude up 1.5% to $68.71 a barrel, Brent crude gains 1.1% to $71.84 a barrel

- Gasoline and heating oil also see increases

- Natural gas falls 4.6% to $2.17 per million BTUs

- Tropical Storm Francine could become a hurricane, causing production disruptions

- Shell and Exxon Mobil adjust operations due to storm

- U.S. Energy Department purchases over 50 million barrels for Strategic Petroleum Reserve

U.S. oil prices rose on Monday as Tropical Storm Francine threatens to disrupt operations in the Gulf of Mexico, with potential hurricane strengthening and China’s strategic oil reserve additions supporting prices. WTI crude gained 1.5% to $68.71 a barrel, while Brent crude increased 1.1% to $71.84 a barrel. Gasoline and heating oil also saw increases. Natural gas fell 4.6%. Companies like Shell and Exxon Mobil adjust operations amid the storm.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about oil futures, Tropical Storm Francine’s potential impact on energy operations in the Gulf of Mexico, China adding to its strategic oil reserve, and the U.S. Energy Department purchasing crude oil for the Strategic Petroleum Reserve. It also discusses concerns over demand, particularly from China, and OPEC+’s decision to postpone production cuts. The information is relevant, well-researched, and not sensationalized or biased.

Noise Level: 3

Noise Justification: The article provides relevant information about oil futures and their fluctuations due to various factors such as Tropical Storm Francine and China’s strategic oil reserve. However, it also includes some repetitive information and focuses on short-term market reactions without delving into long-term trends or possibilities.

Public Companies: Shell PLC (SHEL), Exxon Mobil Corp. (XOM)

Key People: Milad Azar (market analyst at XTB MENA), Phil Flynn (senior market analyst at Price Futures Group), Giovanni Staunovo (commodity analyst), Alex Hodes (analyst at StoneX)

Financial Relevance: Yes

Financial Markets Impacted: Oil futures, energy companies such as Shell PLC and Exxon Mobil Corp.

Financial Rating Justification: The article discusses the impact of Tropical Storm Francine on oil prices and operations in the Gulf of Mexico region, as well as China’s addition to its strategic oil reserve. It also mentions the potential effects on energy companies like Shell PLC and Exxon Mobil Corp. This directly relates to financial topics such as oil futures trading and the stock market performance of energy companies, making it financially relevant.

Presence Of Extreme Event: Yes

Nature Of Extreme Event: Natural Disaster (hurricane)

Impact Rating Of The Extreme Event: Minor

Extreme Rating Justification: Tropical Storm Francine has the potential to become a hurricane and disrupt oil infrastructure in the Gulf of Mexico, causing some companies to evacuate personnel and pause drilling operations. However, it is expected to have a minor impact and not be lasting.

Move Size: The market move size mentioned in this article is 1.5% for West Texas Intermediate crude CL00 for October delivery and 1.1% for November Brent crude BRN00.

Sector: Energy

Direction: Up

Magnitude: Medium

Affected Instruments: Oil futures, Stocks

www.marketwatch.com

www.marketwatch.com