The fragile global economy is at stake as the two economic heavyweights meet

- The U.S. and China are holding a high-level summit to address their economic tensions

- The global economy has been suffering from various crises

- The U.S.-China economic relationship has been deteriorating for years

- The Biden administration has kept many of Trump’s confrontational trade policies

- U.S.-China trade tensions are even higher under Biden

- The rift between Beijing and Washington is causing economic fragmentation

- The IMF estimates that higher trade barriers will subtract $7.4 trillion from global economic output

- The Biden administration insists it isn’t trying to undermine China’s economy

- China is under heavy strain and needs to restore economic cooperation with the U.S.

- Tensions between the U.S. and China go beyond economics

- China’s policies are costing it in the battle for world opinion

The United States and China are holding a high-level summit to address their economic tensions, which have been causing global consequences. The global economy has been suffering from various crises, and having the world’s two largest economies at loggerheads exacerbates the negative impact. The U.S.-China economic relationship has been deteriorating for years, leading to an all-out trade war in 2018. The Biden administration has kept many of Trump’s confrontational trade policies, and U.S.-China trade tensions are even higher under Biden. This rift between Beijing and Washington is causing economic fragmentation, with higher trade barriers subtracting trillions from global economic output. The Biden administration insists it isn’t trying to undermine China’s economy, but China is under heavy strain and needs to restore economic cooperation with the U.S. However, tensions between the U.S. and China go beyond economics, with China’s policies costing it in the battle for world opinion.

Factuality Level: 7

Factuality Justification: The article provides a general overview of the economic tensions between the United States and China and the potential impact on the global economy. It includes some factual information about the trade war initiated by President Trump and the current trade tensions under President Biden. However, it also includes some speculative statements and opinions from experts, which may lower the overall factuality level.

Noise Level: 4

Noise Justification: The article provides some relevant information about the economic tensions between the US and China and the potential impact on the global economy. However, it lacks in-depth analysis and fails to provide actionable insights or solutions. It also includes some repetitive information and does not stay focused on the main topic.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the economic tensions between the United States and China, which can have global consequences and impact financial markets and companies worldwide.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article focuses on the economic relationship between the United States and China and the potential consequences of their high-level summit. While there is no mention of an extreme event, the economic tensions between the two countries have significant financial implications.

Public Companies: International Monetary Fund (), Capvision (), The Mintz Group (), Bain & Co. (), Micron ()

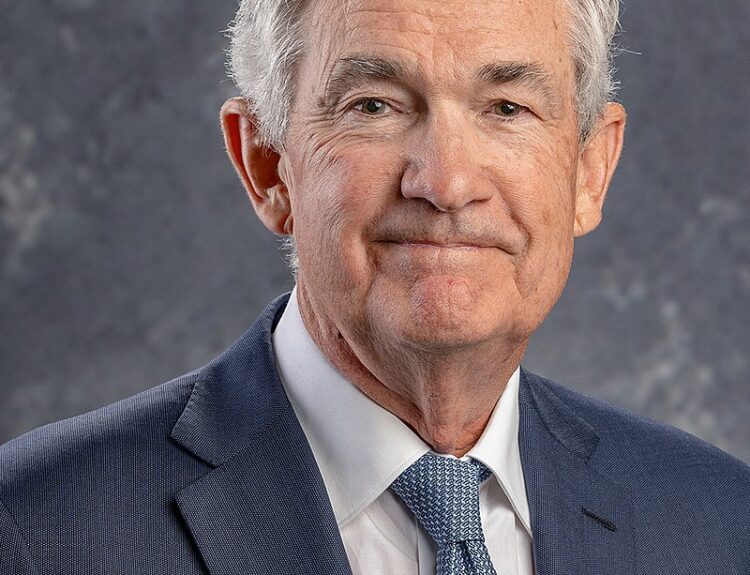

Key People: Joe Biden (President), Xi Jinping (President), Eswar Prasad (Senior Professor of Trade Policy at Cornell University), Mark Warner (Chairman of the Senate Intelligence Committee), Janet Yellen (Treasury Secretary), He Lifeng (Vice Premier), Wendy Cutler (Vice President of the Asia Society Institute and former U.S. trade negotiator), Raja Krishnamoorthi (Illinois Democrat and member of a House committee that monitors China)

www.marketwatch.com

www.marketwatch.com