Auto Industry Anticipates Further Price Drops and Potential Interest Rate Cuts

- U.S. new-vehicle sales slightly increased in Q2 despite higher discounts and lower prices

- Auto industry analysts expect further price drops and potential interest rate cuts to boost sales

- Toyota, Honda, Hyundai, and Subaru reported positive gains while Stellantis, Nissan, and Kia faced declines

- Tesla’s Q2 global sales dropped by 4.8%

- Ford to release sales numbers on Wednesday

New-vehicle sales in the U.S. experienced a minimal increase in Q2, despite higher discounts and lower prices. Auto industry analysts predict further price reductions and possible interest rate cuts to boost sales. Despite these efforts, high prices continue to deter potential buyers. Toyota, Honda, Hyundai, and Subaru reported positive gains, while Stellantis, Nissan, and Kia faced declines. Tesla’s Q2 global sales dropped by 4.8%. Ford is set to release its sales numbers on Wednesday.

Factuality Level: 7

Factuality Justification: The article provides accurate and objective information about the slight increase in U.S. new-vehicle sales in the second quarter, with some details about specific automakers’ performance. It also mentions the impact of cyberattacks on sales and the expected interest rate cuts. However, it lacks more detailed data or analysis to support its claims and could provide a broader context for the industry trends.

Noise Level: 5

Noise Justification: The article provides some relevant information about the auto industry’s second-quarter sales performance but lacks in-depth analysis and fails to explore long-term trends or consequences of decisions. It also does not offer actionable insights or new knowledge for readers.

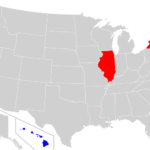

Public Companies: Toyota (7203), Honda (7267), General Motors (GM), Hyundai (005380), Subaru (7270), Stellantis (STLA), Nissan (7201), Kia (000270), Tesla (TSLA), Ford (F)

Key People:

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the impact of new-vehicle sales and discounts on companies such as Toyota, Honda, General Motors, Hyundai, Stellantis, Nissan, Kia, and Tesla. It also mentions the possibility of interest-rate cuts affecting loan affordability.

Financial Rating Justification: The article covers financial topics related to auto sales, company performance, and potential impact on financial markets through interest rates.

Presence Of Extreme Event: Yes

Nature Of Extreme Event: Technological Disruption

Impact Rating Of The Extreme Event: Minor

Extreme Rating Justification: A cyberattack disrupted the software used by dealerships for sales paperwork, causing delays and affecting some automakers’ sales.

www.marketwatch.com

www.marketwatch.com