400 Employees Let Go, $25 Million in Expenses Expected

- UiPath Inc. announces layoff of 10% workforce (420 employees)

- Restructuring costs estimated at $17 million to $25 million

- Stock fell by 5.8% on Tuesday morning

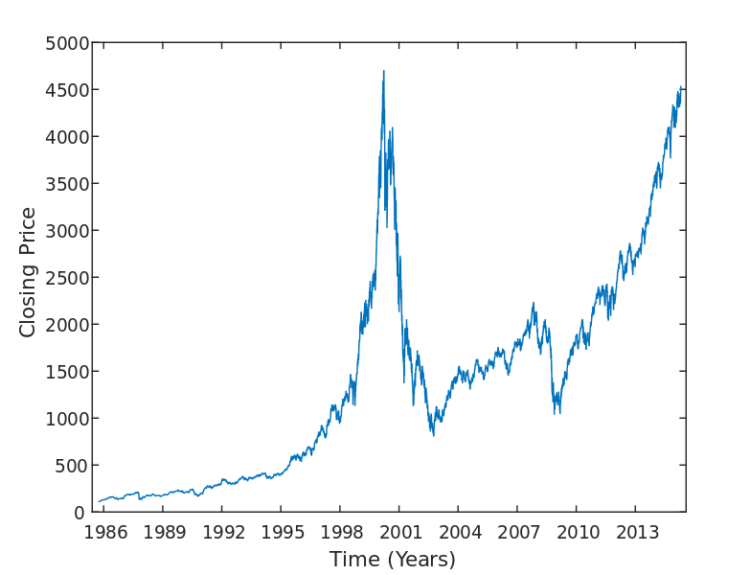

Payment-automation software company UiPath Inc. announced a layoff of 10% of its workforce, affecting around 420 employees as part of a cost-cutting measure. The New York-based firm expects restructuring costs to be between $17 million and $25 million by the first quarter of its 2026 fiscal year. This includes employee termination benefits of $15 million to $20 million and lease exit and other contract-based expenses totaling $2 million to $5 million. The company, which has seen a 48.4% drop in stock value this year compared to the Nasdaq Composite Index’s 22.6% gain, aims to manage expenses through these changes.

Factuality Level: 7

Factuality Justification: The article provides accurate and relevant information about UiPath’s decision to lay off 10% of its workforce as part of a cost-cutting measure and the expected restructuring costs. It also includes the company’s background and stock performance compared to the Nasdaq Composite Index. However, it lacks some details on the specific reasons behind the decision and could provide more context about the impact on the industry or market.

Noise Level: 7

Noise Justification: The article provides brief information about UiPath’s decision to lay off 10% of its workforce and mentions a drop in stock price but lacks depth and context on the reasons behind the decision or potential consequences. It also includes irrelevant text about the company’s services and stock performance compared to the Nasdaq Composite Index.

Public Companies: UiPath Inc. (PATH)

Key People:

Financial Relevance: Yes

Financial Markets Impacted: UiPath’s stock

Financial Rating Justification: The article discusses UiPath Inc.’s decision to lay off 10% of its workforce and the impact on their stock, which affects financial markets as it is a publicly traded company. It also mentions the drop in UiPath’s stock price compared to the Nasdaq Composite Index.

Presence Of Extreme Event: b

Nature Of Extreme Event: Financial Crisis

Impact Rating Of The Extreme Event: Minor

Extreme Rating Justification: The impact is rated as minor due to the company’s decision to lay off 10% of its workforce and restructuring costs, which may affect the stock price but does not have significant long-term consequences or deaths/injuries. The economic impact is limited to the company itself and its shareholders.

www.marketwatch.com

www.marketwatch.com  www.barrons.com

www.barrons.com