Bank stress in the office sector continues to worsen

- A federal bailout for banks caught up in office carnage is unlikely, says economist

- Bank stress in the office sector is far from over

- Banks with exposure to commercial real estate are vulnerable

- Smaller banks are particularly at risk

- Less than 5% of regional bank commercial real estate loans are tied to office buildings

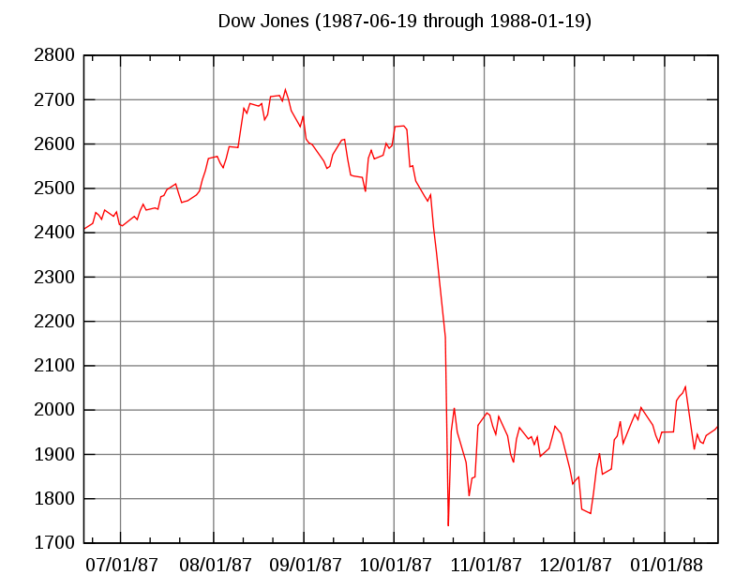

A federal bailout for banks caught up in the office sector carnage is unlikely, according to economist Ryan Sweet from Oxford Economics. Despite the ongoing stress in the office sector, with high vacancies and a wave of debt coming due, Sweet believes that the situation is currently manageable and does not pose a systemic risk to the financial system or the broader economy. However, smaller banks with exposure to commercial real estate are particularly vulnerable, with around 35% of their assets tied to the sector. In contrast, less than 5% of regional bank commercial real estate loans are tied to office buildings. If the damage remains limited to office buildings, Sweet predicts a slow recovery for lenders, similar to the savings-and-loan crisis of the 1980s.

Factuality Level: 3

Factuality Justification: The article provides information about the current situation in the office sector and the potential impact on banks, citing an economist from Oxford Economics. However, the article lacks depth and context, contains some repetitive information, and does not provide a comprehensive analysis of the topic. It also includes some speculative statements and does not offer a balanced view of the situation.

Noise Level: 3

Noise Justification: The article provides relevant information about the current state of the office sector and its impact on banks. It includes data and insights from Oxford Economics and Ryan Sweet, offering a thoughtful analysis of the situation. The article stays on topic and supports its claims with evidence and examples. However, it could benefit from more in-depth exploration of potential solutions or strategies for banks facing challenges in the commercial real estate sector.

Financial Relevance: Yes

Financial Markets Impacted: Commercial real estate sector, regional banks

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the potential need for a federal bailout for banks affected by the office sector’s decline. It highlights the vulnerability of smaller banks with exposure to commercial real estate loans. However, there is no mention of an extreme event or its impact.

Public Companies: New York Community Bancorp Inc. (NYCB)

Key People: Ryan Sweet (Chief U.S. Economist at Oxford Economics)

Reported publicly:

www.marketwatch.com

www.marketwatch.com