The state of the labor market and the economy’s future are uncertain due to unreliable jobs data and increasing inflation risks.

- Jobs data are considered crucial economic signals

- The reliability of labor market data is lacking

- Response rates to labor surveys have been significantly lower since the pandemic

- Slowing job growth is due to less hiring, not more layoffs

- Inflation risks are rising as the economy reaches full employment

- The risk of a second inflation wave has increased

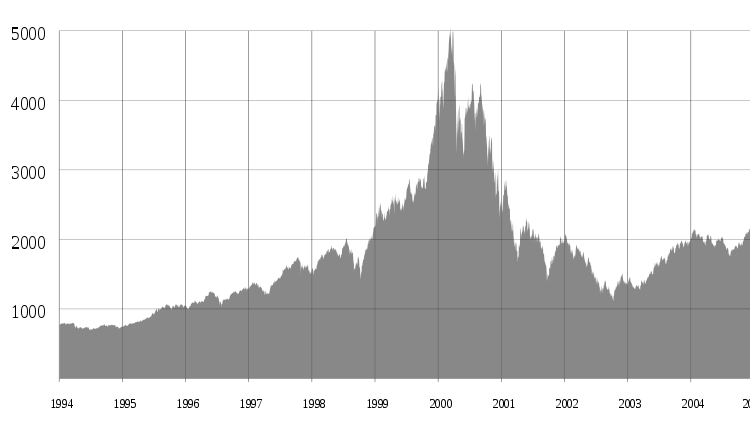

- The S&P 500 experienced a negative “Santa Claus Rally”

- The energy sector was the biggest winner over the past two years

- The Federal Reserve has made a dramatic shift in policy

- Possible explanations for the Fed’s change include a sharp deterioration in the economy or political pressure

The reliability of labor market data is lacking, making it difficult to assess the state of the labor market. Response rates to labor surveys have been significantly lower since the onset of the pandemic, reducing the reliability of initial estimates. Slowing job growth is primarily due to less hiring rather than more layoffs. As the economy reaches full employment, inflation risks are rising. The risk of a second inflation wave has increased, posing challenges for maintaining a soft landing. The S&P 500 experienced a negative "Santa Claus Rally" period, indicating potential challenges for the year ahead. The energy sector was the biggest winner over the past two years, despite a decline in 2023. The Federal Reserve has made a dramatic shift in policy, with a significant change in interest rate forecasts. Possible explanations for this change include a sharp deterioration in the economy or political pressure exerted on the Fed.

Public Companies: Regions Financial (N/A)

Private Companies: undefined, undefined, undefined, undefined

Key People: Richard F. Moody (N/A), Peter Berezin (N/A), Sam Stovall (N/A), Jack Ablin (N/A), Adrian Day (N/A)

Factuality Level: 4

Justification: The article contains some irrelevant information, such as the length of the article and a request for feedback. It also includes some tangential details about the response rate to the December establishment survey and historical performance of the S&P 500. However, the main content of the article provides commentary and analysis from various sources on the state of the labor market, inflation risks, the performance of different sectors, and political pressure on the Fed. While the article does not appear to contain misleading information or propaganda, it lacks depth and comprehensive analysis, and some statements are presented as opinions rather than universally accepted facts.

Noise Level: 3

Justification: The article contains some irrelevant information, such as the mention of text-to-speech technology and a request for feedback. It also includes a disclaimer about the editing of the commentary. However, the majority of the article focuses on economic data and analysis, which is relevant and provides insights into the state of the labor market, inflation risks, market performance, and political pressure on the Fed.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses various economic indicators and trends that can impact financial markets and investor sentiment.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article primarily focuses on economic data and market analysis, without mentioning any extreme events.

www.marketwatch.com

www.marketwatch.com