Inflation Rate Drops to 3%, Fed Rate Cut Speculations Increase

- Inflation eased more than expected in June

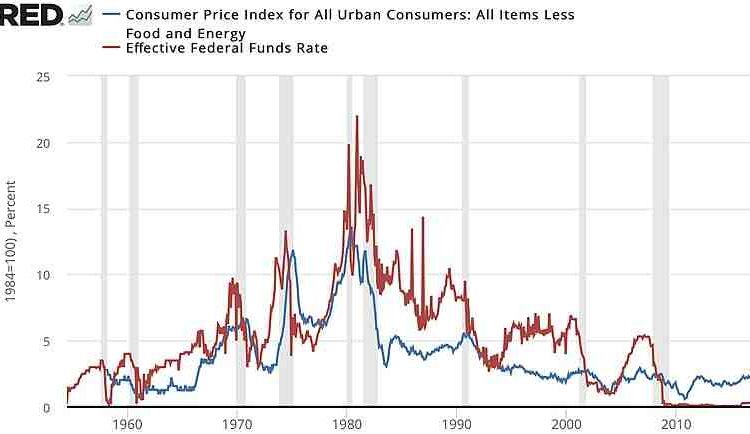

- Consumer-price index rose 3.0% from a year earlier

- Core prices increased by 3.3% over the previous 12 months and 0.1% since May

- Stock futures rose after the release

- Treasury yields fell sharply

- Investors expect Fed rate cut soon

- Fed Chair Jerome Powell hints at potential rate cut in September or December

US inflation eased more than expected in June, with the consumer-price index rising 3.0% from a year earlier and core prices increasing by 3.3% over the previous 12 months and 0.1% since May. Stock futures rose after the release, while treasury yields fell sharply as investors anticipated a potential Fed rate cut. The Federal Reserve Chair Jerome Powell hinted at a possible rate cut in September or December. This comes amidst recent data suggesting a cooling economy but steady job growth.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about the recent inflation data release in the US, its impact on the stock market and bond yields, and how it may affect the Federal Reserve’s decision-making process. It also includes relevant background information and expert opinions without presenting them as universally accepted truths.

Noise Level: 7

Noise Justification: The article provides relevant information about recent economic data and its impact on the Federal Reserve’s decision-making process, but it also includes some unrelated content such as stock market reactions and mentions of other companies and events that are not directly related to the main topic. Additionally, there is a call to action for readers to join the conversation which can be seen as clickbait.

Key People: Jerome Powell (Federal Reserve Chair)

Financial Relevance: Yes

Financial Markets Impacted: US financial markets

Financial Rating Justification: The article discusses the impact of recent inflation data on the Federal Reserve’s potential interest rate cuts and its implications for US financial markets, with stock futures rising after the release of the CPI report and investors focusing on the central bank’s upcoming meeting.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the text.

www.wsj.com

www.wsj.com  www.marketwatch.com

www.marketwatch.com  www.marketwatch.com

www.marketwatch.com  www.barrons.com

www.barrons.com  www.marketwatch.com

www.marketwatch.com  www.marketwatch.com

www.marketwatch.com  www.marketwatch.com

www.marketwatch.com  www.marketwatch.com

www.marketwatch.com  www.marketwatch.com

www.marketwatch.com