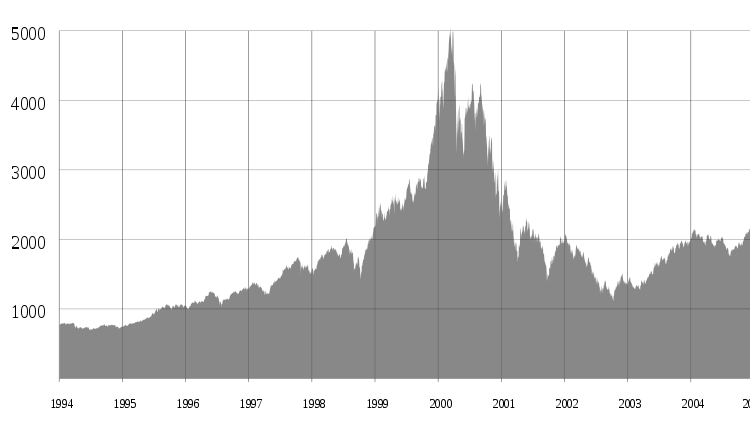

Stock falls 12% despite beating subscriber estimates

- Warner Bros. Discovery stock falls 12% after disappointing earnings

- Fourth-quarter subscriber count beats estimates

- Loss in the period wider than analysts’ forecasts

- Revenue falls short of expectations

- Stock at lowest close since 2009

- Direct-to-consumer subscribers reach 97.7 million

- Advertising revenue in networks segment decreases 14%

- Concerns about game releases for the current year

- Warner Bros. reports profit for direct-to-consumer business

- Company pays down $5.4 billion in debt

Warner Bros. Discovery’s stock took a hit after disappointing earnings results. Although the company’s fourth-quarter subscriber count exceeded expectations, its loss in the period was wider than analysts’ forecasts and revenue fell short. The stock fell 12% to its lowest close since 2009. Warner Bros. reported 97.7 million direct-to-consumer subscribers, beating estimates. However, advertising revenue in the networks segment decreased by 14%. The company also expressed concerns about its game releases for the current year. Despite the challenges, Warner Bros. reported a profit for its direct-to-consumer business and paid down $5.4 billion in debt.

Factuality Level: 7

Factuality Justification: The article provides a detailed overview of Warner Bros. Discovery’s fourth-quarter performance, including subscriber numbers, financial results, and analyst expectations. It includes quotes from the company’s Chief Financial Officer and an analyst, offering different perspectives on the situation. The information presented is based on reported facts and financial data, without significant bias or misleading information.

Noise Level: 3

Noise Justification: The article provides detailed information about Warner Bros. Discovery’s fourth-quarter performance, including subscriber count, financial results, and challenges faced by the company. It also includes analyst opinions and future outlook. The article stays on topic and supports its claims with data and examples. However, it contains some repetitive information and could benefit from more in-depth analysis of long-term trends or antifragility strategies.

Financial Relevance: Yes

Financial Markets Impacted: Warner Bros. Discovery’s stock

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses Warner Bros. Discovery’s financial performance, including its subscriber count, loss, and revenue. There is no mention of any extreme events.

Public Companies: Warner Bros. Discovery (Not available), Netflix (Not available), Disney (Not available), Paramount (Not available), FuboTV (Not available)

Key People: Gunnar Wiedenfels (Chief Financial Officer), Doug Creutz (TD Cowen Analyst)

Reported publicly:

www.marketwatch.com

www.marketwatch.com