Buffett’s investment strategy shifts as tax hike fears loom.

- Kamala Harris proposed raising the corporate tax rate from 21% to 28%.

- Despite tax hike fears, the S&P 500 rose 1% after the announcement.

- Warren Buffett expressed concerns about potential tax increases impacting earnings.

- Buffett sold nearly half of his Apple stake, indicating a shift in investment strategy.

- Buffett’s large portfolio limits his investment options due to high valuations.

- Smaller stocks may present better opportunities for average investors.

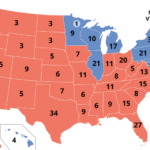

In a recent policy proposal, Kamala Harris suggested increasing the corporate tax rate from 21% to 28%. Surprisingly, the market reacted positively, with the S&P 500 climbing 1% to reach its fifth highest finish on record. This reaction occurred despite the proposal’s potential to reduce domestic earnings by 9%. Even with Harris’s chances of winning being about 50-50 and Republicans having a 72% likelihood of regaining the Senate, the market seemed unfazed. nnWarren Buffett, at the annual Berkshire Hathaway shareholder meeting, voiced his concerns about the current fiscal policies, suggesting that higher taxes are likely as the government seeks to address the growing fiscal deficit. He noted that if taxes increase from 21% this year, they could rise even further in the future. Buffett’s recent decision to sell nearly half of his Apple stake reflects his investment strategy rather than a belief that Apple is undervalued. nnInvestment expert John Huber explained that Buffett’s cash accumulation is due to limited investment opportunities, as his $600 billion portfolio faces constraints from high valuations in large-cap stocks. With only 27 U.S. stocks having a market cap of $300 billion or more, Buffett’s options are dwindling. nnIn contrast, smaller stocks may offer better opportunities for average investors, as they often present a combination of low prices and quality capital allocation. As the market continues to navigate these challenges, U.S. stock futures inched higher, while crude oil prices faced pressure amid geopolitical tensions. nnOverall, while Buffett grapples with tax concerns and investment limitations, the broader market remains resilient, showcasing a complex landscape for investors.·

Factuality Level: 4

Factuality Justification: The article contains a mix of factual reporting and opinion, particularly in the analysis of Warren Buffett’s actions and the implications of Kamala Harris’s tax proposal. There are instances of tangential information and some speculative statements that detract from its overall objectivity. Additionally, the article includes some bias in the presentation of market reactions and political implications.·

Noise Level: 6

Noise Justification: The article provides some relevant information about Kamala Harris’s tax proposal and Warren Buffett’s investment strategies, but it lacks a deeper analysis of the implications of these topics. While it touches on market reactions and investment opportunities, it does not hold powerful individuals accountable or explore the consequences of decisions in a meaningful way. The article includes some data and examples, but it also contains filler content and unrelated tangents that detract from its overall focus.·

Public Companies: Berkshire Hathaway (BRK.B), Apple (AAPL), Tesla (TSLA), Nvidia (NVDA), Palo Alto Networks (PANW), Lowe’s (LOW), Hawaiian Holdings (HA), Alaska Air Group (ALK), GameStop (GME), Advanced Micro Devices (AMD), Palantir Technologies (PLTR), Maxeon Solar Technologies (MAXN), AMC Entertainment (AMC), Taiwan Semiconductor Manufacturing (TSM)

Key People: Warren Buffett (CEO of Berkshire Hathaway), Kamala Harris (Vice President of the United States), John Huber (Investment Manager at Saber Capital Management), Barack Obama (Former President of the United States), Joe Biden (President of the United States), Parag Thatte (Strategist at Deutsche Bank)

Financial Relevance: Yes

Financial Markets Impacted: U.S. stock markets, specifically S&P 500 and Nasdaq Composite

Financial Rating Justification: The article discusses Kamala Harris’s proposal to increase the corporate tax rate, which could impact financial markets and companies. It also mentions the market’s reaction to the proposal, as well as Warren Buffett’s actions at Berkshire Hathaway and his views on valuations in the stock market. Additionally, it covers Lowe’s lowering its sales outlook, Palo Alto Networks’ earnings report, Hawaiian Holdings’ acquisition by Alaska Air Group, and Tesla’s tax rate proposal in Europe.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: The article discusses economic policies and market reactions but does not mention any extreme events that occurred in the last 48 hours.·

Move Size: No market move size mentioned.

Sector: Technology

Direction: Up

Magnitude: Medium

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com