Investors Eye Pricing Strategy and Cost Cuts

- Waste Management is expected to report a net profit of $1.83 per share for Q2

- Q2 revenue is estimated at $5.43 billion

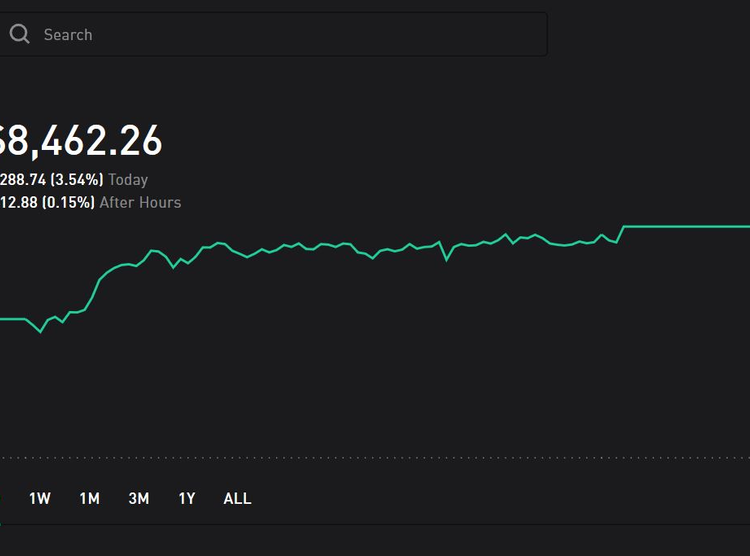

- Stock has increased by 4.7% over the past three months

- Investors should watch for comments on pricing strategy and cost cuts following recent price increases

- Waste Management’s outlook for 2024 revenue growth is currently at 5% to 5.75%

Waste Management is set to report earnings for the second quarter before market open on Wednesday. Analysts predict a net profit of $1.83 per share, up from $1.51 in Q2 last year, with revenue estimated at $5.43 billion compared to $5.12 billion in the same period. The company’s stock has risen 4.7% over three months. Investors will be watching for updates on pricing strategy and cost cuts following recent price increases, as well as the outlook for 2024 revenue growth at 5-5.75%.

Factuality Level: 8

Factuality Justification: The article provides relevant information about Waste Management’s expected earnings and revenue for the second quarter, as well as its stock performance. It also mentions key factors to watch out for in the company’s report, such as pricing strategy and cost cuts. However, it lacks personal opinions or bias.

Noise Level: 3

Noise Justification: The article provides basic financial information about Waste Management’s expected earnings and revenue without offering any analysis or context. It lacks insightful commentary or actionable insights for readers.

Public Companies: Waste Management (WM)

Key People:

Financial Relevance: Yes

Financial Markets Impacted: Waste Management stock

Financial Rating Justification: The article discusses Waste Management’s expected earnings, revenue, and impact on the company’s stock price, which is relevant to financial topics and affects the financial markets and the company itself.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the article.

www.marketwatch.com

www.marketwatch.com