Promising results for lead clinical program

- Werewolf Therapeutics shares jump on positive trial data

- Phase 1 trial data establishes proof of mechanism for lead clinical program

- Stock up 24% in premarket trading

- Data shows WTX-124 well tolerated and delivering IL-2 to tumor microenvironment

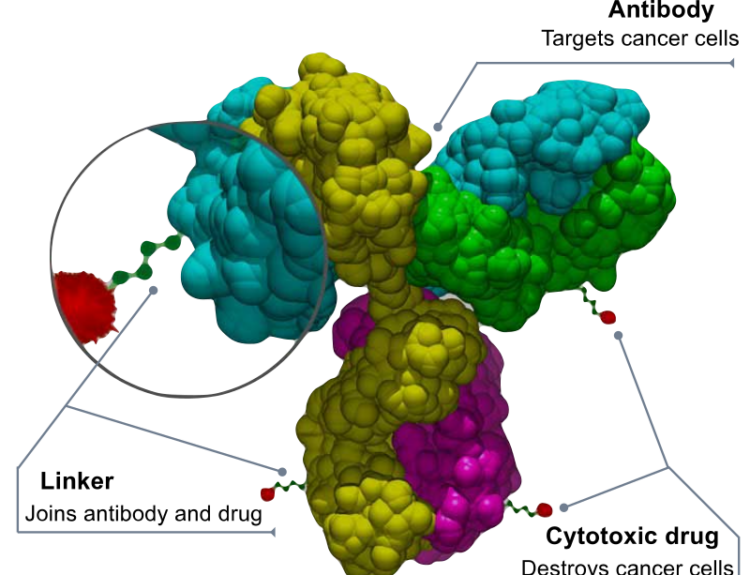

- Two patients show ongoing unconfirmed partial responses

Shares of Werewolf Therapeutics soared after the company presented Phase 1 trial data, which confirmed the effectiveness of its lead clinical program. The data showed that WTX-124, the treatment being assessed in patients with advanced or metastatic solid tumors, was well tolerated and successfully delivered a wild-type IL-2 to the tumor microenvironment. Additionally, two patients in the 12 mg cohort displayed ongoing unconfirmed partial responses. These encouraging results have led to a 24% increase in the company’s stock during premarket trading.

Public Companies: Werewolf Therapeutics (Unknown)

Private Companies:

Key People: Daniel Hicklin (Chief Executive)

Factuality Level: 8

Justification: The article provides specific information about the Phase 1 trial data and the company’s statement regarding the results. It does not contain any obvious bias or personal perspective. However, it lacks in-depth analysis and context, and it could benefit from including more details about the trial and the significance of the results.

Noise Level: 3

Justification: The article provides relevant information about Werewolf Therapeutics’ Phase 1 trial data and the positive impact on the company’s stock. It includes quotes from the Chief Executive and mentions the clinical activity of the treatment. However, it lacks in-depth analysis, scientific rigor, and evidence to support the claims made.

Financial Relevance: Yes

Financial Markets Impacted: Shares of Werewolf Therapeutics

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article pertains to a biopharmaceutical company and its Phase 1 trial data, indicating financial relevance. However, there is no mention of an extreme event or its impact.