The impact on U.S.-China relations and Taiwan’s role in global trade

- Taiwan’s elections will be closely watched by investors

- The choice between candidates will largely come down to economic conditions

- The fundamental dividing line between parties is their stance on China

- A DPP victory could worsen relations with China

- A KMT victory could ease tensions with China

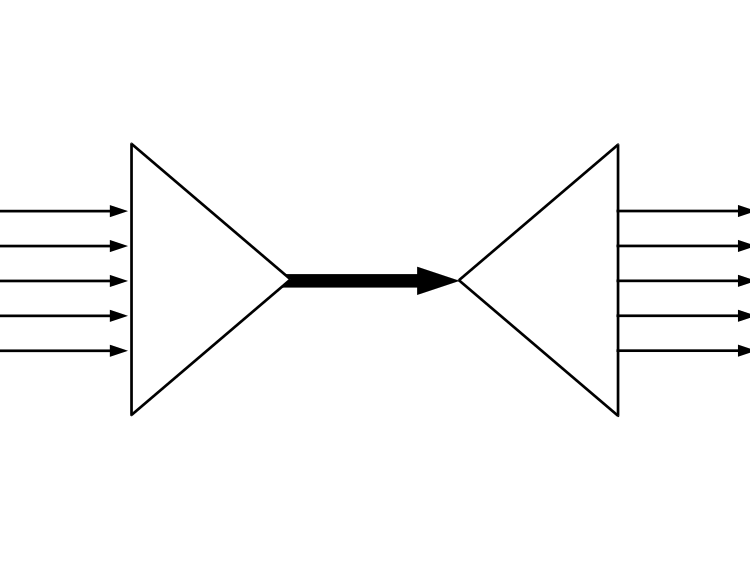

- Taiwan plays a vital role in global trading as a semiconductor manufacturer

- The elections are unlikely to be a game changer in the immediate term

Taiwan’s upcoming elections will be closely watched by investors due to the country’s significant role in the global economy as a semiconductor manufacturer. The choice between the candidates will largely come down to their approaches to improving economic conditions. However, the fundamental dividing line between Taiwan’s political parties lies in their differing stances towards China. A victory for the pro-China KMT could ease tensions with China, while a victory for the more U.S.-aligned DPP could worsen relations. Taiwan plays a vital role in global trading as a major producer of semiconductors, and the elections are unlikely to be a game changer in the immediate term. Regardless of the outcome, the elections will provide increased certainty for markets and have implications for U.S.-China relations.

Public Companies: Taiwan Semiconductor Manufacturing Company (2330)

Private Companies: undefined

Key People: Lai Ching-te (Taiwan presidential candidate), Tsai Ing-wen (incumbent President), Hou Yu-ih (KMT candidate), Jaw Shaw-kong (KMT vice-presidential candidate), Tai Hui (APAC chief market strategist at J.P. Morgan Asset Management), Charles Sunnucks (emerging markets analyst at Oldfield Partners), Brendan McKenna (economist at Wells Fargo), Robert O’Brien (former Trump administration official), Hani Abuagla (senior market analyst at XTB)

Factuality Level: 7

Justification: The article provides information about the upcoming elections in Taiwan and the potential impact on investors and U.S.-China relations. It includes quotes from market strategists and analysts, as well as data on the performance of stock markets and ETFs. However, the article does not provide a balanced view of the different parties’ positions on China and relies heavily on speculation and predictions.

Noise Level: 7

Justification: The article provides some relevant information about the upcoming elections in Taiwan and their potential impact on U.S.-China relations. However, it lacks depth and analysis, focusing mainly on the political parties’ stances towards China and their potential effects on the stock market. The article does not provide a thoughtful analysis of long-term trends or antifragility, nor does it hold powerful people accountable or explore the consequences of decisions on those who bear the risks. It also lacks scientific rigor and intellectual honesty, as it relies on general statements and opinions without supporting evidence or data. Overall, the article contains some relevant information but lacks depth and analysis, making it closer to noise than valuable insight.

Financial Relevance: Yes

Financial Markets Impacted: The article mentions the decline of the Shanghai Composite Index due to fears over China’s policy toward Taiwan. It also mentions the performance of the iShares MSCI China ETF and the iShares MSCI Taiwan ETF.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the upcoming elections in Taiwan and their potential impact on U.S.-China relations and the global economy. While there is no mention of an extreme event, the political dynamics between Taiwan and China have financial implications.

www.marketwatch.com

www.marketwatch.com